Azkoyen

Top-Tier management team. Attractive valuation. Clear path to value creation.

Brief Summary: Azkoyen, a Spanish small-cap company with a market capitalization of approximately €178 million, is listed on the Madrid Stock Exchange and specializes in the manufacture of vending machines, payment systems, and automation solutions. Founded in 1945, Azkoyen went public on July 18, 1988, marking the beginning of its expansion into international markets. The company currently trades at a P/E ratio of 8x and an EV/EBITDA multiple of 6x, both lower than its competitors. Coinstar was acquired by Apollo on September 27, 2016, at 7x EV/EBITDA and 14x earnings, while Ingenico was acquired by Worldline in 2020 at around 15x EV/EBITDA.

Company Overview

Azkoyen, founded in 1945 in Navarra by Martín Luis Troyas Osés, began its journey in the agricultural machinery sector and, in 1956, entered the vending industry with the development of its first dispensing machine. During the 1960s and 1970s, it expanded its product range with innovative coin selection systems and vending machines for tobacco, sweets, and beverages. In 1970, the company underwent a key transformation by becoming a public limited company, attracting new investors and professionalizing its management, marking its evolution from a family business to the Azkoyen Group. In the following years, it strengthened its growth by developing advanced electronic solutions for vending and transportation. In the 1980s, it began its international expansion and, in 1988, debuted on the Madrid Stock Exchange. Today, the Azkoyen Group is a leading multinational technology company in payment solutions, access control, and vending, with a presence in over 60 countries and a workforce exceeding 1,000 employees. It specializes in the design, manufacturing, and commercialization of advanced technological solutions for the vending and HORECA/OCS markets, payment systems, and security. Since its foundation in 1945, the company has been distinguished by its commitment to technology, research, and the development of new products.

Azkoyen Group - portfolio of brands:

1. Coffee & Vending Systems

Azkoyen: The original brand of the group, known for its proprietary technology in professional coffee machines and vending solutions. Azkoyen offers expert advice through an extensive international network.

Coffetek: A leading UK brand in beverage-dispensing machines, renowned for its innovative and user-friendly designs. Azkoyen acquired Coffetek in 2008, expanding its reach in the UK market.

Ascaso: Specializes in artisanal espresso machines, offering superior quality and personalized coffee solutions. Acquired in 2022, Ascaso further strengthened Azkoyen's position as a global leader in coffee equipment.

2. Payment Technologies

Azkoyen Payment Tech: A European leader in cashless and cash payment systems, offering tailored solutions for key sectors like banking, retail, and transportation.

Coges: Specializes in cash management and telemetry solutions, providing innovative systems that streamline payment processes, particularly in the retail sector. Azkoyen acquired Coges in 2005, enhancing its payment technologies portfolio.

Cashlogy by Azkoyen: Provides automated payment solutions for point-of-sale transactions, improving operational efficiency and customer experience. Azkoyen launched Cashlogy in 2012.

Vendon: Focuses on IoT, telemetry, and digital payment solutions, specializing in monitoring coffee and vending machines. Vendon was acquired by Azkoyen in 2022, strengthening the company's connectivity solutions for vending operations.

3. Time & Security

Primion: Offers integrated solutions for access control, time registration, visitor management, and security, enhancing safety and efficiency in industries such as healthcare, airports, and public buildings. Azkoyen acquired 91% of Primion in 2008, expanding its time and security solutions, and later on bought the rest of the company.

Opertis: Manufactures electronic locking systems and advanced security solutions for sectors like hospitality, public administration, and commercial buildings. Azkoyen acquired Opertis in 2016, further bolstering its security offerings.

Business Model

Azkoyen operates as a vertically integrated technology provider, specializing in three core segments: Coffee & Vending Systems, Payment Technologies, and Time & Security. Its business model revolves around designing, manufacturing, and distributing high-tech solutions, including vending machines, cash management systems (e.g., Cashlogy), and biometric access controls. Serving businesses across hospitality, retail, corporate, and public sectors, Azkoyen capitalizes on the increasing demand for automation, convenience, and security.

With a global footprint spanning over 95 countries and 85% of revenue generated internationally, Azkoyen benefits from economies of scale through its 10 production plants and extensive distribution network. The company’s revenue model combines one-time hardware sales with recurring income streams, ensuring a balance between upfront capital expenditure and steady cash flow. While product sales drive initial revenue, ongoing earnings stem from maintenance contracts, spare parts, and software-based services, such as IoT-enabled remote monitoring and cashless payment integrations.

Azkoyen’s competitive edge lies in innovation and scalability, reinforced by an annual R&D investment exceeding €17 million and a strong patent portfolio (59+ patents). Proprietary technologies like MIA brewing for premium coffee extraction and Distance Selection for touch-free vending differentiate its offerings. However, potential risks include high R&D costs, economic downturns affecting business spending, and supply chain complexities due to its global manufacturing footprint. Despite these challenges, its diversified segments and strategic focus on digital transformation position Azkoyen for sustained growth amid rising automation and security trends.

Operational entities of the company:

Executive Team

Azkoyen has long been recognized for its exceptional leadership, a standard that continued under CEO Darío Vicario Ramírez, who served for just a year and a half before resigning at the end of 2024. Having taken on the role in 2022, Vicario brought with him extensive experience at the company since 2018, ensuring a smooth transition and the continuation of the strategic expansion launched by his predecessor, Eduardo Unzu, in 2010. The executive leadership has decided not to appoint a successor, opting instead to restructure the group.

Azkoyen’s Board of Directors is characterized by a balanced composition of proprietary, independent, and executive directors, fostering effective governance. This structure ensures an optimal balance between the independence of non-executive directors and the strategic influence of the major shareholders. Key board members include, for example, Carolina Maseveu, who holds an 11.45% stake in the company, and Diego Fontán, her husband, who serves as a proprietary director and owns 150,000 shares, representing 0.61% of the company. This diverse and strategically structured board enhances Azkoyen's competitive position in the global market, driving sustainable growth.

The compensation structure at Azkoyen is strategically aligned with the company’s overall performance, ensuring that executive incentives are tied to the long-term success of the organization. Juan José Suárez Alecha, the Chairman, receives the highest compensation, exceeding €200,000 annually, which represents less than 1% of the revenue for 2024. Both Darío Vicario, the Ex-CEO, and Esther Málaga García, the Independent Director, earn salaries exceeding €100,000, reflecting their strategic contributions to the company’s growth, while other board members receive compensation below this threshold. The executive team's variable compensation is linked to several key factors, including financial performance, achievement of strategic goals, individual performance, and market conditions. Financially, the structure takes into account targets related to profitability, revenue growth, and stock performance, particularly relevant for publicly traded companies. Furthermore, the achievement of long-term strategic objectives, such as market expansion or product innovation, directly influences bonus calculations. The evaluation of individual executive performance—focused on leadership, decision-making, and the results of key projects—is also a critical element. Short-term bonuses are tied to immediate financial results, while long-term incentives are based on sustainable value creation and successful completion of significant strategic projects. Lastly, external factors such as market conditions, industry competitiveness, and the accomplishment of sustainability and corporate social responsibility (CSR) goals play a pivotal role in determining variable compensation.

Shareholders

Azkoyen benefits from a stable, family-driven shareholder structure consisting of several families and investment funds. This structure reinforces the company’s resilience and continuity. Many of the company’s shareholders also hold positions within the management team, aligning their interests with the company’s success and fostering a culture of shared responsibility for growth. Notably, La Previsión Mallorquina de Seguros, a company focused on stability and low-risk investments, is involved, reflecting a strong belief in Azkoyen’s long-term prospects. Additionally, Muza, a seasoned investment company with a track record dating back to 1999, invests with a value-driven approach, emphasizing knowledge, prudence, and patience. Overall, the shareholder structure is robust and well-balanced, contributing to Azkoyen’s ongoing success and stability.

Note: I don’t believe we will see a takeover bid (OPA). If there had been intentions to launch a public acquisition offer, they would have had the opportunity to do so at much lower prices. The current position of the shareholders is purely financial.

Risks

Forex: Fluctuations in exchange rates and currency mismatches between the base currency (EUR) and the local currencies in the markets where Azkoyen operates may impact financial results. This risk is relatively low, as the majority of the company’s revenues are in euros.

Economic recession: An economic downturn, particularly in Europe, Germany, and Spain—its primary markets—could hinder investment activity and negatively affect the company’s performance.

Operational: Managing 10 production plants and a global supply chain introduces risks related to logistics, component shortages and cost inflation.

Inventory control: Accumulating inventory can be a potential issue; not selling products could negatively affect the company’s financial performance.

Mergers and Acquisitions (M&A): A poorly executed acquisition could significantly affect the company's performance. Overpaying for assets or acquiring companies that do not add value to the group could undermine long-term profitability and strategic goals.

Stock liquidity: As a smaller-cap company with limited analyst coverage, Azkoyen's stock may experience volatility. If the market undervalues its innovation pipeline, it could remain overlooked by investors.

Competitive advantage

The group does not present a clearly defined competitive advantage over other market players. However, financial data suggests otherwise, as companies possessing a defensive moat ("moat") tend to be more profitable than those without one.

One of the primary indicators for assessing this advantage is the Return on Invested Capital (ROIC), which I consider a key metric in this analysis. Azkoyen has demonstrated consistent growth in this area, and it is projected to maintain a ROIC above 12% in the long term. Similarly, the company has maintained an average EBITDA margin of 15.2% from 2013 to 2024, surpassing the market average. Additionally, Azkoyen benefits from vertical integration, allowing it to control its entire production chain and achieve greater operational efficiency. Furthermore, by handling the maintenance of its machines, the company retains a high percentage of its customers, further strengthening its competitive position.

Another notable factor is Azkoyen’s historical track record. The company’s deep market knowledge and the strong commercial foundation it has built over time provide it with a significant advantage in terms of experience and customer relationships.

Key numbers

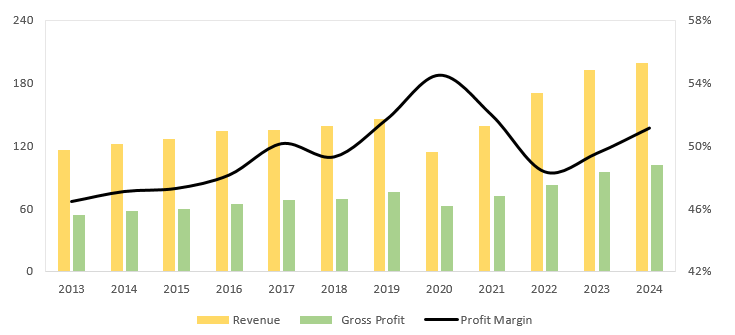

Azkoyen is one of the leading players in Europe across the segments in which it operates. From 2013 to 2024, the company achieved a compound annual growth rate (CAGR) of 5.05% in revenue, while operating income grew by nearly 10% per year, maintaining stable margins close to 11%. The company’s gross margin has fluctuated between 45% and 55%, and its operating margin has ranged from 7.5% to 13.5%, reflecting its high operational efficiency. In 2020, a year marked by the pandemic, Azkoyen saw a 21.6% decline in sales, which was understandable given the sectors in which it operates. However, it managed to maintain a stable gross margin through cost reductions despite a slight dip in the EBITDA margin. In the face of adversity, the company leveraged its strong financial position and reduced its debt by 72.5% (0.2x EBITDA). In 2022, another year marked by global economic uncertainty due to the Russia- Ukraine war, Azkoyen seized the opportunity to acquire two companies, although inflationary pressures and the global crisis’ cost overruns slightly reduced its margins. By 2024, the company achieved a record net profit of €18.8 million, a 7.2% increase over 2023, with its gross margin surpassing 50% again. Furthermore, it generated Free Cash Flow to the Firm (FCFF) of €33 million, with expectations of continued growth in the coming years.

Azkoyen has a well-balanced revenue structure, with no single segment significantly outperforming the others, reducing the company's reliance on any one area of its business. In the past, the Time & Security division represented a larger share, accounting for nearly 44.5% of the company’s sales in 2013. However, this proportion has gradually decreased over time. Overall, based on my projections, all segments are expected to continue growing steadily, with each maintaining a relatively consistent contribution to the company’s revenue, without any particular segment standing out significantly above the others.

The company maintains a positive working capital, which is critical given its operational cycle, where payments are made upfront and collections occur at a later stage. Azkoyen finances this working capital through short-term credit facilities. However, this does not pose a risk to the company, as it has a robust financial structure: in 2024, it reduced its net debt by 66.3% and currently holds a net debt/EBITDA ratio of just 0.3x, indicating a low level of financial leverage.

Azkoyen’s operational requirements vary across its segments. In the Coffee & Vending Systems and Time & Security divisions, inventory levels of equipment and spare parts are higher. Conversely, in the Payment Technologies segment, the company typically experiences longer receivable cycles. As reflected in the following table, inventory has increased, with the most notable growth occurring between 2022 and 2023. This was driven by the company’s proactive strategy to secure products and services for its customers in anticipation of potential supply chain disruptions, as well as preparing for an anticipated increase in sales. The cash conversion cycle remains appropriate and in line with industry norms, although further improvement towards a cycle closer to 100 days would be desirable.

Azkoyen's capital allocation strategy is centered on several key priorities:

Research and development: A substantial portion of the company’s capital is directed towards R&D, focusing on the development of advanced vending machines, payment systems, and IoT solutions. This commitment to innovation ensures that Azkoyen remains competitive and responsive to evolving market demands.

Organic growth and efficiency: Capital is reinvested in manufacturing, maintenance, and expanding in markets, ensuring long-term growth and operational efficiency.

Shareholder returns: Azkoyen offers a dividend yield of approximately 5%, underpinned by strong profits and cash flow, as reflected in a payout ratio of 50% and a cash payout ratio of 26.2%. While the company is capable of sustaining dividends, its dividend history has shown volatility, including suspensions in 2020 and significant reductions in 2022-2023. As such, investors seeking stable dividend income may find Azkoyen less attractive.

Debt management: Azkoyen adopts a conservative approach to debt, maintaining strong control over its financial leverage.

Acquisitions and investments: The company has historically pursued strategic acquisitions to enhance its technological capabilities and market position. This approach aligns with Azkoyen’s broader strategy of expanding automation and technology solutions.

Valuation

To assess Azkoyen’s value, two main approaches have been employed in this summary analysis:

A Discounted Cash Flow (DCF) model projected over a five-year horizon.

A relative valuation based on EV/EBITDA multiples, applied through a sum-of-the-parts breakdown of Azkoyen’s business segments.

While this summary focuses on the two primary valuation methods for the sake of simplicity and clarity, the full analysis incorporates additional models and a range of scenario-based evaluations—including downside and alternative cases—offering a more comprehensive and robust perspective on potential valuation outcomes. Readers are encouraged to conduct their own analysis, as this represents only a high-level summary of the base-case valuation.

1. Discounted Cash Flow (DCF) Valuation

The DCF model projects performance through 2029, assuming an EBIT margin of 12.7%, a terminal growth rate of 1.5%, and a WACC of 8.47%. The discount rate reflects the weighted average risk-free rates of the countries in which Azkoyen operates, with a 20-basis-point stress factor incorporated.

Under these assumptions, the DCF yields a valuation of €11.60 per share, implying an upside potential of over 40% compared to the current market price of €8.

2. Relative Valuation (EV/EBITDA - Sum-of-the-Parts)

In the relative valuation approach, each of Azkoyen’s business segments is evaluated individually by comparing it to the most relevant peer group in its respective industry. This method assumes that each business line could be independently valued in line with industry norms.

In the Vending Machines division, Azkoyen trades at an EV/EBITDA multiple of 4.83x, significantly below the sector median of 8.75x, indicating the market may be undervaluing its core operations despite stable cash flows and margin expansion potential.

In Payment Solutions, the company is valued at 10.48x, slightly below the sector average of 12.00x. Although this segment benefits from growing demand for cashless technologies, the discount may reflect market concerns about competitive pressures or slower adoption in certain regions.

The Time & Security segment shows an EV/EBITDA of 14.89x, which is only marginally below the peer group average of 15.50x, suggesting this segment is more fairly valued, likely due to stronger visibility of earnings and higher barriers to entry.

By applying these sector multiples to Azkoyen’s expected EBITDA for each business line, and then adjusting the aggregate enterprise value for net debt and minority interests, we derive an estimated equity valuation of €13.90 per share, implying an upside potential of over 70%.

This sum-of-the-parts analysis highlights a substantial valuation gap across all divisions, particularly in vending, which may provide significant re-rating potential if operational performance improves or if investor sentiment shifts.

Final Valuation

Given the absence of directly comparable listed peers and the integrated nature of Azkoyen’s business model, greater weight is given to the DCF method (80%) compared to the multiples-based valuation (20%). This results in a blended target price of €12.00 per share. Applying a 10% margin of safety to account for potential forecasting errors or macroeconomic shocks, the adjusted fair value is €10.85 per share.

Conclusion

Azkoyen is a true gem among Spanish companies, operating in a sector with strong long-term prospects. Currently, the company trades at significantly lower multiples compared to other players in the industry. While its country of origin may not attract significant attention in the investment landscape, Azkoyen presents solid future prospects. The management team is of the highest caliber and is committed to creating value for both the company and its shareholders.

The undervaluation of Azkoyen can be attributed to several factors: it is a small-cap company operating in a sector with limited appeal, it is listed in a country with low visibility in international markets, and it has low liquidity. However, in my view, these characteristics make Azkoyen an attractive investment, particularly because of its shareholder structure, which demonstrates a strong alignment with the company’s long-term goals. The family ownership underscores a deep financial commitment to the business, further strengthening its investment appeal.

Disclaimer: This is a personal analysis and does not constitute any buying or selling recommendations. Each investor should make their own due diligence.

Has the CEO not resigned as of the end of FY2024?