Baguio Green Group

Founder-led. One of the biggest players in a boring sector. Low multiples.

Brief Summary: Baguio Green Group is a leading Hong Kong family-controlled environmental services company, providing cleaning, landscaping, pest management, and waste management & recycling solutions. Founded in 1980 by Ng Wing Hong, the company has grown into a technology-driven, multi-segment platform with strong government and private-sector partnerships. With a robust contract backlog, consistent revenue and EBITDA growth, and a diversified service portfolio, the company trades at an EV/EBITDA of 2.9x, P/E of 6.0x, and a free cash flow yield of 54%, offering significant upside relative to its intrinsic value.

Company Overview

Founded in Hong Kong in 1980 by Ng Wing Hong (Ben), Baguio Green Group began as a small cleaning service addressing the city’s growing demand for professional environmental hygiene, financed entirely with founder capital. On 7 May 1982, Baguio Cleaning was formally incorporated with an authorised share capital of HK$200,000, shared among Ben Ng, Ng Wing Chuen, and Ng Wing-sun. Operations initially focused on street and commercial cleaning services around 1996. Driven by Ben Ng’s vision to create a full-spectrum environmental services platform, the Group strategically expanded with the establishment of Baguio Landscaping in 1995, Baguio Pest in 2005, and Baguio Waste in 2008. Strategic acquisitions, including Tak Tai in 1997, a government-approved landscaping supplier, and the leasing of plant nurseries, further strengthened capabilities and diversified the client base. Ng Wing-sun, Ben Ng’s brother and co-founder, played a key role during these formative years before departing in 2010 to pursue other business ventures.

Under Ben Ng’s leadership as Chairman and Executive Director, Baguio evolved from a local cleaning company into a diversified, technology-driven environmental solutions provider. His approach emphasises disciplined, investment-led growth, operational reliability, sustainability, and innovation. Today, Baguio is a trusted partner to the Hong Kong SAR Government, public utilities, commercial enterprises, universities, amusement parks, and the airport, delivering scalable, eco-friendly solutions across multiple sectors.

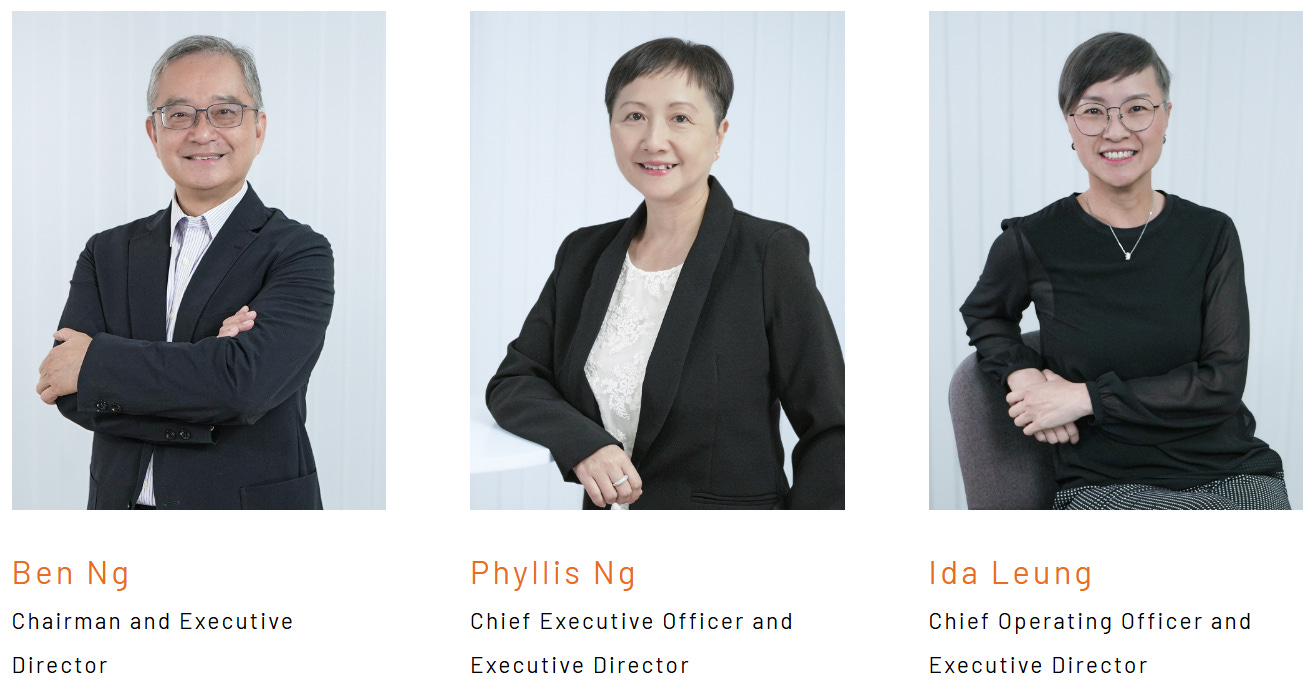

The Group’s executive management blends founder-led continuity with professional expertise. Phyllis Ng (Ng Yuk Kwan), Ben Ng’s sister, serves as Chief Executive Officer and Executive Director, overseeing strategy, operations, and organisational development. Ida Leung, Chief Operating Officer and Executive Director, manages operational delivery across all service segments.

Listed on the Main Board of the Hong Kong Stock Exchange since 2014, Baguio now operates a one-stop integrated environmental services platform organised into four core segments:

Cleaning & Hygiene: Professional cleaning across streets, public spaces, commercial and industrial buildings, schools, shopping malls, and transport facilities. Specialised services include high-level cleaning, confined space maintenance, marble restoration, and antimicrobial coating applications. The segment leverages advanced equipment and trained personnel to maintain hygiene, efficiency, and safety. In 2025, Baguio expanded its services to the marine environment, providing comprehensive marine cleansing in Victoria Harbour and surrounding waters. This includes fleet deployment and intensified cleaning operations before and after major events such as fireworks displays, dragon boat races, and cross-harbour swims, ensuring clean and safe waters while extending the company’s land-based expertise to Hong Kong’s marine ecosystem.

Landscaping: Baguio Landscaping delivers landscape construction, maintenance, and greening projects for public and private clients, including plant nurseries and horticultural expertise. Services emphasise sustainable green space development aligned with government and corporate environmental standards.

Pest Management: Provides environmentally responsible pest prevention and control using integrated pest management (IPM) practices, combining monitoring, preventive strategies, and safe chemical applications to protect public health while minimising environmental impact.

Waste Management & Recycling: Covers municipal, commercial, industrial, construction, animal, food, chemical, and clinical waste. Services include collection, transportation, confidential waste destruction, waste audits, and event management. Advanced recycling and resource recovery facilities, including a food-grade plastics recycling plant, waste paper and glass recycling plants, and composting operations, support circular economy objectives. Technology adoption, including AI, IoT, and big data, enhances sorting, tracks recycling efficiency, and engages communities through initiatives such as the iRecycle mobile app.

By combining operational scale, technological innovation, and a diversified service portfolio, Baguio Green meets Hong Kong’s growing demand for sustainable environmental solutions. Its integrated platform, supported by advanced infrastructure and smart technologies, positions the Group to drive efficiency, enhance resource recovery, and contribute to the city’s transition toward a circular, low-carbon economy.

Market Commentary

Hong Kong’s environmental services sector is evolving through policy-driven, incremental enhancements despite the city’s high population density and limited developable land. With approximately 40–50% of land designated as country parks and nature reserves, and a total green space of around 47%, the city has a strong natural baseline for urban greening. Government initiatives, including the Greening Master Plan, skyrise greening programs, and the 10-year biodiversity strategy, promote integration of greenery into urban planning through tree planting, green roofs, vertical greening, and improved park management. Ambitious targets to increase public open space per capita to 2.5–3.5 m² by 2030 are expected to drive demand for professional greening, landscape maintenance, and climate-adaptive urban infrastructure, while urban canopy coverage and connectivity remain constrained by development pressures.

The cleaning, hygiene, pest management, and waste management sectors provide stable, recurring revenues underpinned by strict public health regulations, high-density living, and a subtropical climate, with post-COVID hygiene standards further reinforcing structural demand. Waste management and recycling are gaining strategic importance as Hong Kong advances toward its Zero Landfill 2035 target, with municipal solid waste recycling at 34% in 2024 and construction waste recovery above 90%. The government’s Northern Metropolis development, covering roughly one-third of Hong Kong’s land in the New Territories North, represents a long-term growth driver, integrating housing, technology, logistics, and environmental conservation. The project emphasises integration of conservation and development, with planning principles that aim to balance urbanisation with protection of rural landscapes and ecologically important areas, including wetlands, country parks, and potential eco-tourism nodes, alongside proposals for conservation parks and green corridors that support ecosystem services. This expansion offers opportunities for greening, waste and recycling solutions, and ecosystem management, while highlighting the need for climate-resilient and regulatory-compliant services.

Hong Kong’s marine environment faces significant pressures from urban development, heavy maritime traffic, and pollution from sewage, agricultural runoff, and microplastics, leading to habitat degradation, biodiversity loss, and algal blooms. Victoria Harbour, the city’s central waterway, is particularly impacted due to dense shipping, recreational use, and frequent large-scale events such as fireworks displays, dragon boat races, and cross-harbour swims, which intensify waste accumulation and water quality risks. Other vulnerable areas include nearby waters at Central, Sheung Wan, Causeway Bay, Tsim Sha Tsui, Yau Ma Tei, Shau Kei Wan, Kwun Tong, Sai Kung, Tolo Harbour (Tai Po), as well as typhoon shelters including Causeway Bay, Shau Kei Wan, Kwun Tong, To Kwa Wan, New Yau Ma Tei, Sam Ka Tsuen, Shuen Wan, Yim Tin Tsai, and Sai Kung Town. To mitigate these threats, the government has implemented interdepartmental marine refuse management, enhanced shoreline cleanups, coastal patrols, water quality monitoring, and public education campaigns, aiming to safeguard water quality and maintain ecological and recreational value across Hong Kong’s key marine zones.

Business Model

Baguio Green Group Ltd operates as a defensive, integrated environmental services provider in Hong Kong, delivering cleaning, waste management, recycling, landscaping, and pest control services under long-term contracts with government agencies, statutory bodies, and large private enterprises. Its revenue model is highly recurring and contract-driven, providing strong cash flow visibility and resilience through economic cycles. The company complements this stable base with technology-enabled solutions, including IoT smart recycling systems, solar-powered compactors, and circular economy initiatives, which enhance operational efficiency and ESG alignment without materially increasing risk. By combining a diversified service portfolio with a durable, government-backed revenue base, Baguio Green Group is well-positioned to benefit from structural trends in urban environmental management and sustainability policy.

Shareholding Structure

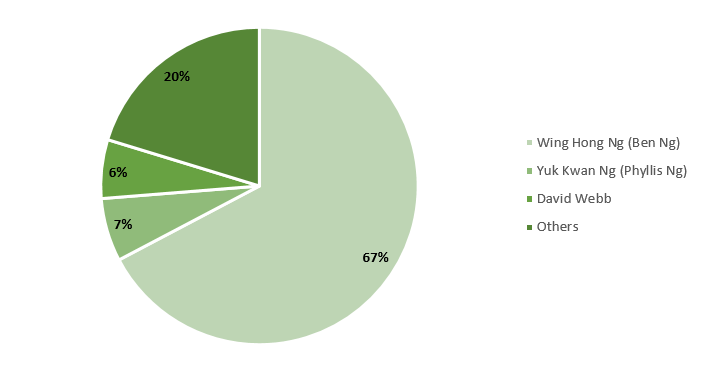

Wing Hong Ng, the founder of the company, is the largest shareholder, holding 67.29% of the company, with his sister, Yuk Kwan Ng, as the second-largest shareholder at 6.44%. Together, the Ng family controls 73.73% of the company. David Webb, who passed away recently, may he rest in peace, and who was widely recognized as a brilliant and highly influential activist investor, a champion of transparency and investor rights whose investigations and sharp commentaries unsettled the financial elite, held 5.99% of the company. This stake is expected to pass to his family, and, given David Webb’s legacy, it is believed that they will continue to maintain it.

Before proceeding, I would like to provide a paragraph about who David Webb was, a reference point for many of us:

David Webb was a prominent figure in Hong Kong’s financial markets, known for his activism and commitment to transparency. Born in Britain, he moved to Hong Kong in 1991, retiring from banking to focus on market reforms and shareholder advocacy. Webb built his fortune through small- and mid-cap stocks, achieving approximately 20% annual returns since 1995, and founded Webb-site, a platform for exposing corporate misconduct. He played a pivotal role in uncovering the 2017 Enigma Network scandal and contributed to reforms at HKEX. A longtime champion of corporate transparency, tax reform, and investor rights, Webb once said, “I was more interested in leaving some mark on the system than just dying rich.” His efforts have left a lasting impact on Hong Kong markets, ensuring his legacy endures. Rest in peace, David.

Risks

Client concentration: reliance on a limited number of key clients, mainly Hong Kong government departments, with active diversification into private and new markets.

Investments and acquisitions: expansion initiatives, including potential acquisitions, may not deliver expected returns or face integration challenges.

Labour costs and workforce shortages: vulnerability to wage increases and difficulties in hiring and retaining skilled staff, historically impacting gross margins.

Fleet management: accidents or inadequate maintenance of the vehicle fleet could disrupt operations and generate liabilities.

Intense competition in cleaning, landscaping, and pest control may erode margins; differentiation relies on green technology and integrated services.

Extreme weather events, such as typhoons, can threaten employee safety and increase operational costs.

Regulatory changes affecting recycling operations may impact profitability due to shifts in government policies or delays.

Interest rate fluctuations affect costs due to variable-rate loans.

Credit risk from non-government clients, monitored continuously.

FX exposure, primarily from RMB-related operations in mainland China.

Key Numbers

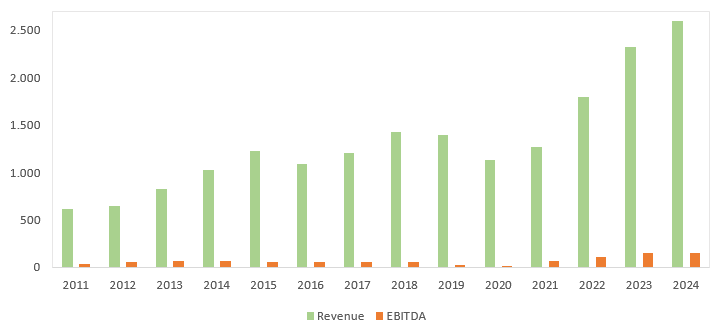

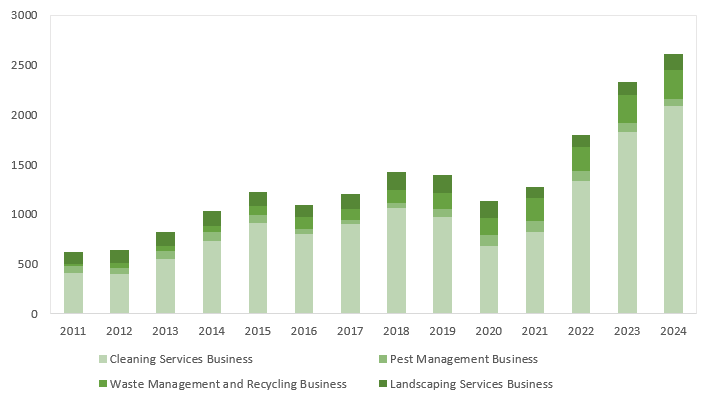

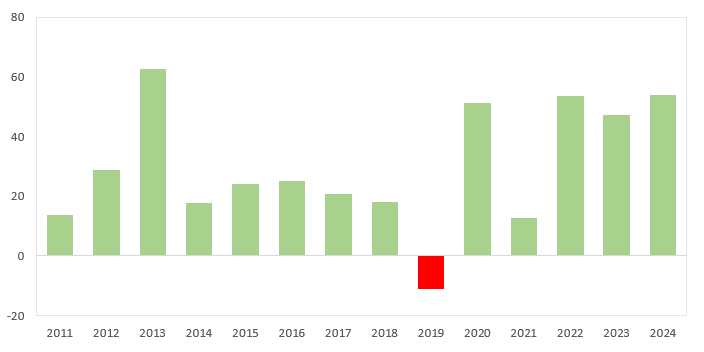

Baguio Green is a family-owned company and one of Hong Kong’s largest integrated environmental services groups, serving as a market leader in urban cleaning and a leading provider of recycling and waste management solutions for public-sector clients. Backed by a substantial portfolio of long-term contracts, the company continues to secure both government and private engagements, demonstrating growth potential within its current markets and beyond. Over the past decade, Baguio Green has delivered a consistent and robust track record, achieving a 13-year revenue CAGR of 11.7% and EBITDA CAGR of 12.9%.

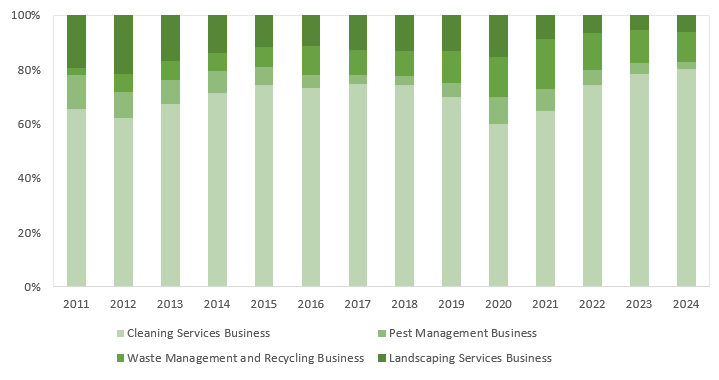

The Group’s operations are divided into four main segments

The Cleaning segment, the Group’s core business, accounts for approximately 80% of total revenue and has achieved a 13.4% CAGR from 2011 to 2024. Margin expansion has been driven by disciplined cost management, operational scale, and the successful acquisition of new government contracts. In October 2025, the Group further reinforced its market position by securing a three-year, HK$150 million marine cleaning contract covering Hong Kong’s eastern waters, including Victoria Harbour and Sai Kung. The segment continues to enhance operational efficiency and advance ESG outcomes through technology adoption and strategic integration with downstream recycling and upcycling initiatives.

The Recycling & Waste Management segment, representing around 11% of revenue, has been the fastest-growing business, achieving a 28.1% CAGR over the same period. Growth is supported by policy tailwinds, including the “Zero Waste 2035” strategy and extended producer responsibility schemes for plastic packaging. Baguio Green plans to evolve this segment further, moving beyond conventional recycling into higher value-added upcycling, transforming recovered materials into premium products, and expanding door-to-door household recycling through the iRecycle platform to increase participation and community engagement.

Landscaping continues to exhibit steady margin expansion but low revenue growth, with a 2.23% CAGR over the same period, supported by rising demand linked to the Northern Metropolis development, which is expected to be a key medium- to long-term growth driver. The segment also presents opportunities to integrate circular economy practices through the use of recycled and upcycled materials. The Pest Management segment remains highly competitive and contributes minimally to overall Group performance, though it benefits indirectly from cross-selling opportunities and Baguio Green’s broader sustainability-focused service offerings.

Revenue Visibility & Contract Backlog

Revenue visibility through Baguio Green Group’s contract backlog is a key driver of its financial stability, ensuring steady cash flow and mitigating operational uncertainty. As of June 30, 2025, the total value of unexpired contracts amounted to HK$3,099.4 million, with the cleaning division comprising the largest share at HK$2,334.0 million. This was recently reinforced by a HK$150 million, three-year marine waste cleaning contract that commenced in October 2025. Waste management and recycling account for HK$471.0 million, supported by the expansion of the “GREEN@COMMUNITY” network and new Environmental Protection Department contracts totalling HK$43 million. Landscaping contributes HK$245.4 million through high-margin projects such as Kai Tak Sports Park and Tung Chung New Town extensions, while pest control maintains a stable HK$49.0 million. Revenue recognition is well-defined, with HK$1,043.9 million expected in the remainder of 2025, HK$1,354.2 million in 2026, and HK$701.3 million secured beyond 2027.

The backlog is underpinned by a historically strong tender success rate of 35.6–37%, a concentration in public-sector clients that minimises default risk, and growth opportunities from major infrastructure developments such as the Northern Metropolis. Compared to the HK$3,887.5 million backlog at December 2024, the current level reflects normal contract cycle transitions, particularly in landscaping, and reinforces Baguio Green’s competitive advantage: the scale and expertise required to manage large government contracts create substantial barriers to entry for new competitors.

Recent Challenges

In 2019, Baguio Green faced significant operational challenges. Widespread social unrest in Hong Kong disrupted urban cleaning operations and forced a temporary suspension of recycling activities, including glass collection and processing. At the same time, mass demonstrations reduced outdoor consumer activity, lowering waste collection volumes. The tightening labour market increased direct wage costs, compressing gross margins, while delays in landscaping projects further impacted segment profitability. Elevated interest rates and higher average borrowings also increased financial costs. As a result, the company reported a net loss of HK$11 million for the year.

In 2020, Baguio Green confronted the dual challenges of the COVID-19 pandemic and sector-specific pressures. Hong Kong experienced four waves of infections, resulting in a record GDP contraction of 6.1%. As a major employer of frontline personnel, the company implemented stringent infection control measures, which, together with an initial shortage of personal protective equipment (PPE), significantly increased operational costs. The recycling and waste management segment was particularly impacted: temporary closures of bars, restaurants, and nightclubs halted glass collection, while international regulatory changes, including China’s ban on plastic waste imports and amendments to the Basel Convention, disrupted plastic waste exports. Legislative delays, such as the slow implementation of the Municipal Solid Waste Charging Scheme, further constrained citywide sustainability initiatives.

At the segment level, the urban cleaning division’s revenue declined 30.5% due to the expiration of several large-scale service contracts, while landscaping experienced weakened demand and intensified competition, further pressuring profitability. Overall, group revenues fell 19% year-on-year, and total headcount declined from 7,457 in 2019 to 5,255 in 2020. Despite these challenges, Baguio Green returned to profitability, largely supported by government measures totalling approximately HK$84.9 million, including the Employment Support Scheme. Without these subsidies, financial results would have reflected the full operational impact of the year’s disruptions.

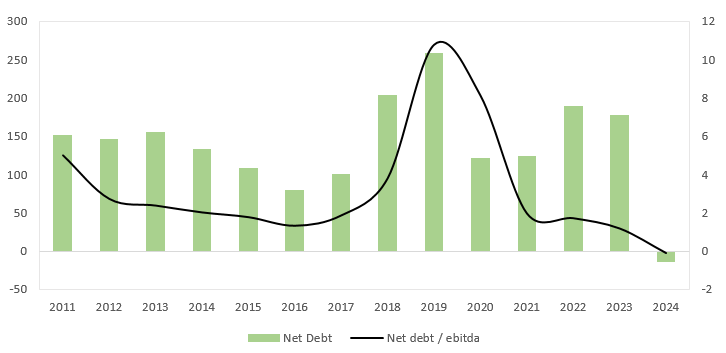

Financial Position

The Group has steadily strengthened its financial position, closing 2024 with a net cash balance and further increasing liquidity to HK$192.5 million in the first half of 2025. By contrast, 2019 represented a peak in leverage, with a Net Debt/EBITDA ratio of 10.79×, as the company relied on significant bank borrowings to sustain operations and investments amid narrowing margins and rising costs. Under the leadership of Ng Wing Hong (Ben), Baguio Green has substantially improved its financial health while maintaining disciplined growth. The company is now leveraging this strong financial foundation to pursue long-term expansion, consolidating its market leadership in Hong Kong while exploring new services, including marine cleaning and international operations, and selectively pursuing growth through mergers and acquisitions. With robust cash reserves and ample financial flexibility, the Group is well-positioned to bid for large-scale contracts and expand operational capacity, reinforcing its status as a regional leader in integrated environmental services and green technology. We expect the Group to remain debt-free in the coming years.

Valuation

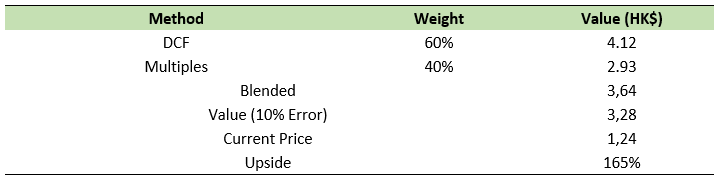

Please note that the following valuation reflects only the base-case scenario, while downside risks have been modelled separately. Investors are encouraged to conduct their own valuation analysis based on their individual assumptions and projections. The valuation of Baguio is primarily based on a Discounted Cash Flow (DCF) model with a five-year explicit forecast period, complemented by a relative valuation approach using EV/EBITDA and P/E multiples. This summary forms part of a broader and more comprehensive valuation framework that incorporates additional scenarios and alternative methodologies to provide a more robust assessment of the company’s intrinsic value. Accordingly, investors should perform their own due diligence before drawing any investment conclusions.

A DCF model is deemed appropriate given the company’s improved earnings visibility since 2023 and the nature of its business model, which is characterised by long-term contracts and stable demand for essential services. These features materially reduce forecasting risk and, consequently, the margin of error relative to other sectors and companies. For the purpose of this valuation, an EBIT margin of 2.5% is assumed, which is conservative compared to both the industry average and the company’s historical margin of 3%. A terminal growth rate (g) of 0.5% and a discount rate (WACC) of 12.5% are applied. The terminal growth rate is deliberately conservative, particularly in light of the company’s long-term track record of double-digit growth. The WACC is calculated by weighting the risk-free rate and incorporating an additional stress premium to reflect the company’s size, the current market environment, and country-specific risks. Based on these assumptions, the DCF analysis yields a fair value of HK$4.12 per share, implying an upside potential of over 232% relative to current market prices.

For the relative valuation, an EV/EBITDA multiple of 7.0x is applied, which is significantly below the sector average and median of 12.5x and 11.7x, respectively. This results in an implied valuation of HK$3.11 per share. Using the P/E approach, a multiple of 13.0x—also below the sector average and median—is applied, leading to a valuation of HK$2.76 per share.

By combining both methodologies using a 60% weighting for the DCF and 40% for the multiples-based valuation, a blended fair value of HK$3.64 per share is obtained. As a standard practice to mitigate potential optimism in the underlying assumptions, a 10% margin of safety is applied to ensure a more conservative outlook. Even after this adjustment, the stock continues to offer an upside potential of approximately 165% relative to current price levels.

Conclusion

Baguio Green Group is a founder-led enterprise that has demonstrated consistent improvement in its financial health over time. It operates within a critical and increasingly strategic sector, and despite its presence in an unattractive industry, the company exhibits strong long-term fundamentals. The management team is clearly committed to the company’s future, including its expansion beyond current markets. The company’s current market undervaluation appears driven by several factors: a small market capitalisation of under €60 million, operation in a sector with limited investor appeal, listing in a jurisdiction historically scrutinised for transparency and investor protections, and relatively low liquidity, which may constrain broader market interest. These structural characteristics, however, enhance Baguio Green Group’s investment appeal, particularly given the substantial equity stake held by its founders, signalling robust alignment with long-term shareholder value. Overall, the company is well-positioned for sustainable performance, and it is only a matter of time before the market fully recognises its intrinsic value.

Disclaimer: All information provided herein by smallvalue is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell an interest in any security. Smallvalue may change its views about or its investment positions in any of the securities mentioned in this document at any time, for any reason or no reason.

Great as always.