Please note that nothing posted should be construed as a recommendation to buy or sell. This summary provided here represents only a fraction of the comprehensive research conducted. My analysis encompasses various scenarios, so what you see published is just a condensed overview.

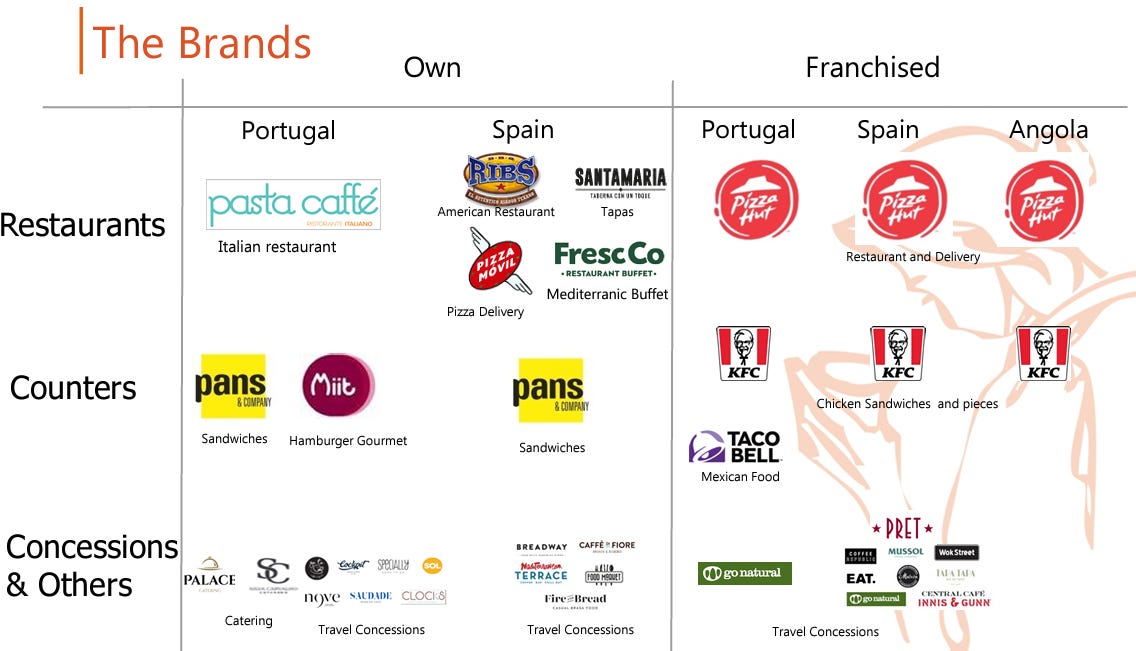

Established in 1997 by António Pinto Sousa and Alberto Teixeira, Ibersol specializes in managing fast-food restaurant chains across Spain, Portugal, and Angola. Originally a part of Sonae, a Portuguese conglomerate, Ibersol now oversees renowned brands like Pizza Hut, KFC, and Burger King. Guided by the same leadership since its inception, the company has maintained a strong presence, evidenced by its listing on the PSI-20 index. Despite navigating challenges during the COVID-19 pandemic, including the imperative to raise capital and respond to evolving consumer behaviours, Ibersol has showcased resilience and adaptability. With a steadfast commitment to innovation and customer satisfaction, the company continues to flourish, offering diverse dining experiences and fostering sustainable growth within the industry.

One of the company's key strategies has been its focus on franchising, particularly with renowned international brands like Burger King, Pizza Hut, KFC, and Taco Bell. However, recent developments, such as the sale of Burger King restaurants for €260 million, have sparked interest in Ibersol's potential as an investment opportunity. Despite this influx of cash, the market response has been subdued, presenting a unique situation for potential investors to consider.

Main event in Ibersol in recent years – Burger King sale.

The divestiture of Burger King by Ibersol in November 2022 had a profound impact on the company's financial landscape. In this transaction, Ibersol received €244.5 million in cash plus an earn-out of €15.5 million. Burger King, as Ibersol's flagship brand, had been a major contributor to the company's earnings, leaving Ibersol with a substantial cash reserve but also raising questions about its future investment strategies. However, Ibersol adeptly navigated this transition without adverse consequences, bolstering its financial position through measures such as extraordinary dividend distribution, debt reduction (€83.4 MM in debt repayment + €16.6 MM associated with the Burger King sale operation), and cash reserve augmentation over the past year. Additionally, Ibersol launched a share buyback program, acquiring a notable percentage of its outstanding shares, commencing in June and extending until May 31, 2024 (4,4359,577 - representing up to 10.29%). Furthermore, the company eliminated treasury shares as of May 26, 2023 (-3,640,423), and witnessed Fergie acquire a 10.74% stake previously held by SGPS, a company owned by the CEO and Teixeira and Barbosa. These strategic manoeuvres underscore Ibersol's proactive stance in asset management and commitment to enhancing shareholder value post-Burger King divestiture.

Management team.

Huge skin in the game. Ensuring management incentives are in sync with shareholders' interests is typically crucial, but given the substantial capital relocation at hand, it becomes paramount.

Let's introduce the dynamic duo. The company is under the stewardship of two lifelong partners, António Pinto Sousa and Alberto Teixeira, who hold the record for the longest tenure as managers of a company listed on the primary Portuguese stock index. In 1997, this pair orchestrated a management buyout of Ibersol, funded in part by an IPO. Before this, Ibersol was a subsidiary of Sonae, a prominent conglomerate in Portugal. Over subsequent decades, Ibersol enjoyed an average sales growth rate of approximately 9%, until the onset of the pandemic. Despite challenging macroeconomic conditions, such as the European Sovereign crisis from 2011 to 2013, wherein the Iberian region was particularly hard hit, capital allocation remained commendable. Capital allocation has been very good for decades, generating an average ROIC of between 9-12%, which represents good management and the ability to create value on the part of the company.

These two friends collectively hold roughly a 56% stake in the company, valued at approximately €165 million at current market rates. This amount surpasses their combined annual salary of €1 million by over a hundredfold and a substantial portion of their overall wealth. Both Mr Teixeira and Mr Pinto Sousa have a significant vested interest in the company's success, ensuring their alignment with the broader shareholder base.

Jumping into its numbers.

Ibersol has demonstrated consistent growth in various key metrics, including the number of establishments, revenues, income, and EBITDA since 2000. However, it experienced a notable deceleration during the financial crisis of 2009-2012 and the pandemic-induced challenges of 2020-2021. The most significant surge in its performance occurred in 2016 following the acquisition of Eat Out Group, which propelled its establishment count from 377 to 504.

Recent years have presented a myriad of significant events, complicating direct comparisons. Factors such as the implementation of new European accounting standards (IFRS 16) in 2019, the disruptions caused by the COVID-19 pandemic in 2020 and 2021, legislative changes impacting its concessions sector by AENA in 2021, and the strategic sale of BK to private equity firm Cinven in 2022 have all exerted considerable influence.

In 2023, the group inked a pivotal agreement with Pret A Manger, a renowned British chain specializing in sandwiches and coffees, signalling its commitment to further consolidation in the Iberian Peninsula. Plans to open 70 new establishments across Spain and Portugal over the next decade underscore its growth ambitions. With only one opening in Barcelona, ample expansion opportunities remain untapped. During the year it opened its first two prets in Spain, specifically at the Barcelona Josep Tarradella Airport.

Ibersol operates within a seasonality industry where sales typically peak in the second half of the year, accounting for roughly 60% of the annual total. The anticipated uptick in sales and revenue in the upcoming years is half driven by projected growth in airport traffic and consumer spending, particularly attributed to tariff reductions. Furthermore, the company is in the initial phase of new concession contracts, specifically 11, for the airports of Madrid, Tenerife, and Malaga. Currently, these contracts are pending completion of the reform process and thus not yet recognized as concessions. Upon their operationalization, these locals are expected to significantly increase future income streams.

Over the past decade, Ibersol has witnessed a remarkable revenue surge of over 140%. Despite encountering hurdles amid the turbulent 2020-2021 period induced by the widespread ramifications of the COVID-19 pandemic on brick-and-mortar establishments, Ibersol has demonstrated resilience, maintaining a robust balance sheet with a Free Cash Flow (FCF) of €47 million. The accompanying chart vividly depicts the temporary setback hardened during this phase, mirroring broader market sentiments. Furthermore, I expect the company to reclaim pre-pandemic revenue levels by 2026.

Regarding net income, Ibersol experienced a significant downturn in 2023, plummeting by 90%. This decline stemmed from escalating costs, the implementation of new reforms, and personnel expenditures, among other factors. Nonetheless, while substantial, this decline is not inherently detrimental. However, I was taken aback by the extent of the drop.

The company maintains a steady dividend, albeit at a relatively modest level. However, there is ample opportunity for it to prioritize investment in growth initiatives. I place little emphasis on the dividend and do not anticipate increases in this regard. Instead, I prefer that the company directs its resources towards generating shareholder value through growth initiatives or share buybacks.

After a challenging 2023, the lingering presence of high-interest rates persists as a concern, placing strain on household finances and casting a shadow over consumption, particularly within the restaurant industry. Forecasts for Portugal and Spain improved for 2024, accompanied by an anticipated decline in inflation and subsequent easing of interest rates. Despite geopolitical uncertainties such as instability in the Middle East and ongoing conflict in Ukraine impacting consumer sentiment, recent indicators, notably airport traffic, suggest that tourism-dependent markets in southern Europe will exhibit resilience, tempering the anticipated consumption deceleration. The ongoing conversion of new concession restaurants at pivotal airports, including Lanzarote, Madrid, Tenerife, and Malaga, is expected to present profitability challenges until their transition to definitive formats and concepts is finalized. Expansion initiatives for brands like Pizza Hut, KFC, Taco Bell, and Pret A Manger remain integral to its operational growth strategy. Furthermore, considering the success of other franchise models like Rodilla, the possibility of diversifying within the sector is not discounted. Additionally, the acquisition of Medfood is poised to bolster revenues, given its operation of 31 KFC outlets. I am optimistic that Ibersol will surpass 95 million euros in revenues solely from its KFCs.

Looking forward to the trajectory of Ibersol, a reduction in maintenance CAPEX is on the horizon, attributed to the perceived lower investment requirements linked with the openings of new franchises and concessions. As for free cash flow, significant changes are not foreseen, given the continuous expansion of locals and potential acquisition endeavours, notably the complete integration of Medfood (buy the entire company), which will bolster its KFC expansion ambitions with 31 additional outlets. The strategic outlook underscores a focus on establishing stores with robust margins and low operating costs.

Amidst its good financial performance and promising prospects, Ibersol appears undervalued in the current market landscape. With a P/E ratio of merely 6x, significantly lower than its historical average of over 12x, and the sector average of 20 times, the company presents an enticing investment opportunity. Similarly, the EV/EBITDA ratio stands at a modest 5x, well below the sector norm, particularly when juxtaposed with the valuations of industry giants such as Amrest and Yum Brands.

While Ibersol's yields are good, they do not necessarily confer a substantial advantage over its competitors. However, there remains optimism for their augmentation in the long run.

Nevertheless, it's imperative to acknowledge the inherent risks associated with investing in Ibersol. Operational uncertainties, including lease renewals and evolving consumer preferences, pose potential challenges to the company's performance. Additionally, the competitive landscape presents a formidable hurdle, with the emergence of new players threatening market share. Moreover, the expansion of the franchise business exposes Ibersol to credit risks, albeit diligently managed by prudent management practices.

Furthermore, Ibersol's perceived lack of liquidity may not necessarily be a deterrent for investors. On the contrary, it could offer an opportunity to acquire the company at a discounted valuation compared to a more liquid market. Moreover, investing in a less liquid asset allows investors to harness its potential without succumbing to excessive volatility, thereby fostering long-term value creation. As the company continues to deliver robust performance, its shares are poised to gain traction, gradually enhancing liquidity and investor interest over time.

Valuation.

For the valuation of Ibersol, a DCF analysis will be used until 2027 with a discount rate of 7.55% and a terminal growth rate of 3%. A risk-free rate of 3.80% to stress the value. This results in a valuation of €11.63

If I value using multiples, assigning a P/E ratio of 20x, an EV/EBIT of 12x, an EV/EBIT of 19x and an EV/FCF of 20x, we obtain a price of €10.27. If we weigh each valuation equally, I have a weighted target price of €10.95, representing an upside of more than 56% from the current prices (€7).

The valuation is conducted in a neutral scenario, although I usually incorporate a 5% margin of error on the price in case my projections turn out to be too optimistic and vary. Applying this discount, I obtain a target price for the company of €10.40, representing a 49% increase.

Conclusion.

I find this opportunity to be highly compelling for several reasons. The strategic collaboration with Pret A Manger, expansion in its main source of income (KFC and Taco Bell), and buying of Medfood, coupled with Ibersol's expertise in digital transformation and its alignment with the growing demand for convenient food options, positions the company for significant future success. With a net cash position, robust growth, active share buybacks, and directors holding around 56% ownership, coupled with limited analyst coverage, the company presents a promising investment profile. Despite facing challenges in the pandemic-hit industry, it deserves a higher valuation, given its strong fundamentals. Moreover, potential catalysts such as evolving consumer trends or expansion plans through new concessions and new restaurant openings, could further enhance its valuation. Compared to peers (AmRest mainly), it appears undervalued and exhibits superior quality. Looking ahead, it's vital to monitor food trends, labour market dynamics, and shifts in consumer behaviour, including factors like VAT and consumer confidence. Currently, I maintain confidence in the company and trust its management to continue making prudent investments, as evidenced by its track record thus far.

Disclaimer:: It's essential to note that this analysis is for informational purposes only, and individuals should conduct their due diligence before making any investment decisions.

As much as I like Ibersol I find the write up flawed in many respects from basic accounting figures (eg profit from BK sale) to comps and valuation. It does not give a clear view of the business or the main figures of the company. Comparing with Restaurant Brands in the table says a lot. Ibersol does not deserve a 22p/e and you cannot have such a gap between DCF and comp valuation which clearly indicates the DCF is wrong. How much shares have Ibersol bought back? Is it a considerable amount? The industry is not cyclical (it has seasonality) and debt is not minimal (there is a large net cash position). I hope you can improve in next write ups