Orsero: A Leading Fresh Produce Distributor

Low valuation multiples. Skin in the game (~33% Raffaella Orsero).

Brief Summary: Orsero S.p.A., based in Milan, is a leading company specializing in the import and distribution of fresh fruit and vegetables throughout the European Mediterranean region. Founded 80 years ago by the Orsero family, the company has significantly expanded its operations, establishing a strong presence in Italy, France, Spain, Portugal, and Greece. It also operates a production facility in Mexico, Comercializadora de Frutas Acapulco, which focuses on growing avocados for the U.S. market. In 2023, Orsero reported revenues of €1,540.80 million and has been listed on the Euronext STAR segment in Milan since 2019.

Company Background

With a market capitalization of €225.27 million, Orsero is a key player in the fresh produce market. The company originated from the GF Group, which faced substantial challenges from 2007 to 2013 due to management missteps, including an ill-fated airline acquisition. However, since 2014, the company has successfully refocused on its core business of fruit distribution, implementing significant management reforms and strategic restructuring.

In 2017, a pivotal moment in its corporate history, Orsero emerged from a reverse merger with Glenalta Food, facilitating its listing on the stock exchange without an IPO and gaining a €75 million capital injection. This strategic manoeuvre underscored Orsero's commitment to growth and financial stability.

Recent strategic Acquisitions

Orsero has adopted a proactive acquisition strategy to fortify its market position and diversify its portfolio. Recent transactions include strategic acquisitions and joint ventures that have significantly enhanced its market footprint.

2017: Acquired the remaining 50% stakes in three joint ventures: Hermanos Fernández López, Fruttital Firenze, and Galandi.

2023: Established a joint venture called I Frutti di Gil in partnership with Cerchia Holding, where Orsero holds 51% of the share capital. Additionally, Orsero owns 100% of CAPEXO and 80% of Blampin Groupe.

These acquisitions have bolstered Orsero’s operational capabilities and market reach, reinforcing its leadership in the Mediterranean fresh produce market.

Business Model

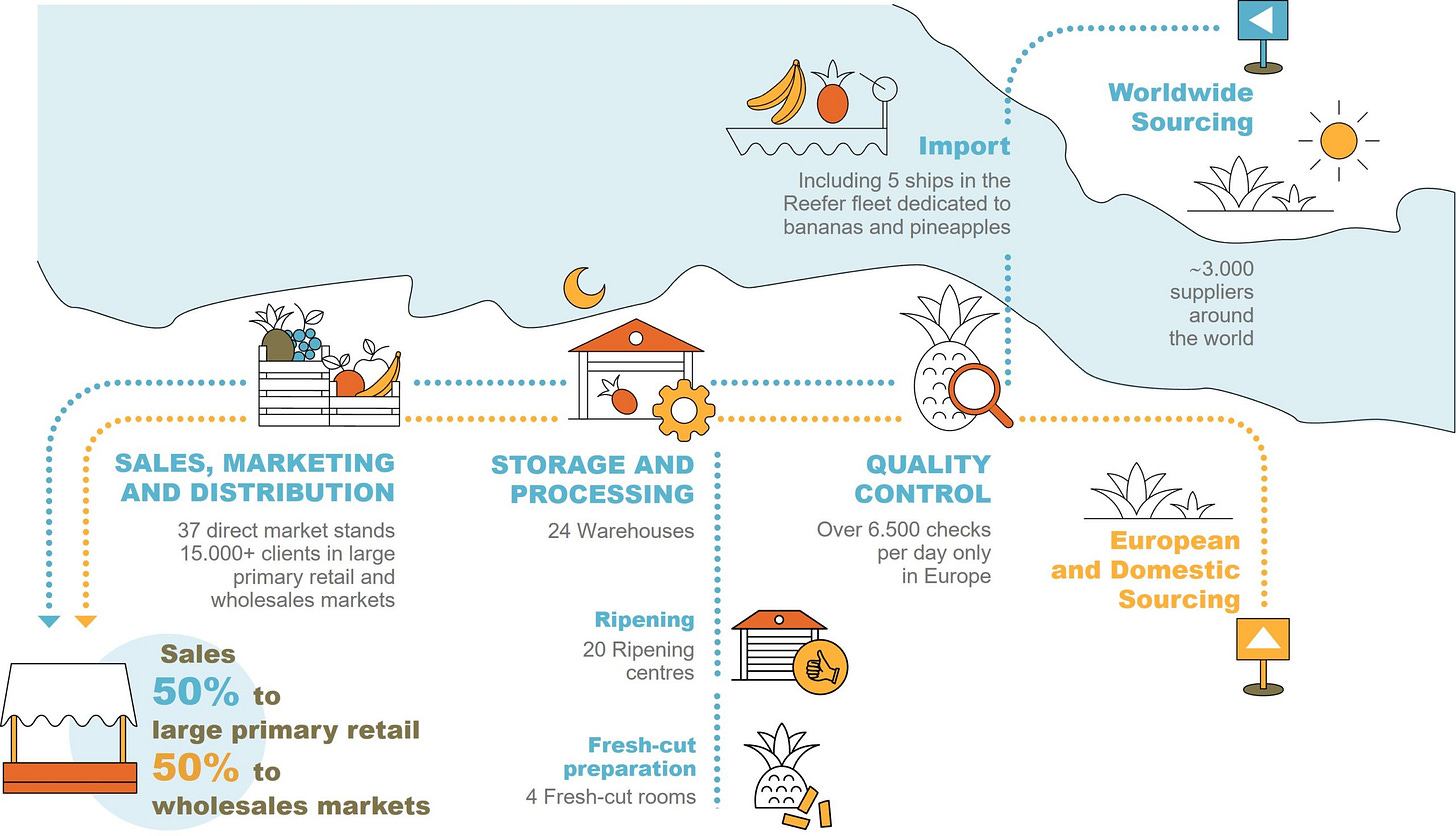

Orsero generates revenue primarily through the distribution of fresh fruit and vegetables, accounting for over 90% of its gross turnover. The company sources products from global suppliers, which are imported into Italy and other European markets for distribution to supermarkets and retailers. Orsero also sources from local suppliers and distributes products within their country of origin. The company's strengths lie in its comprehensive management of the supply chain and its expertise in logistics, handling, storage, transportation, and distribution, all of which ensure that products remain fresh and high-quality. Additionally, Orsero markets products under its own brands, which enhances profitability. Strategic acquisitions and geographical expansion further bolster its customer base and create additional revenue opportunities.

Importation: Orsero specializes in importing fruit and vegetables from around the world for distribution across Europe. Its extensive network of suppliers and global markets guarantees a steady supply of fresh, high-quality products.

Distribution and logistics: The company operates a comprehensive network of its own distribution centres and warehouses, including 25 warehouses, 21 ripening centres, and 4 fresh-cut product plants. This infrastructure enables optimal storage and transportation, maintaining quality throughout the supply chain. Orsero's distribution activities cover a wide range of fresh fruits and vegetables year-round, focusing on the Mediterranean regions of Europe (Italy, France, the Iberian Peninsula, and Greece) and Mexico, where it also engages in avocado production and export.

Operation of retail outlets: Orsero owns and manages a variety of market stands across Europe, including 37 direct market stalls. This allows the company to sell directly to traditional market operators and enhance its retail presence.

Value-Added and services: The company provides packaging, labelling, and product customisation services, adapting to the specific needs of each market, which adds value to its offering and allows it to differentiate itself from the competition.

Products Offered: A wide range of fruits (bananas, citrus fruits, apples, grapes, kiwis, mangos, avocados and berries) and vegetables (tomatoes, cucumbers, peppers, lettuces, carrots, courgettes). It also markets special products such as exotic fruits, root vegetables, and fresh herbs, as well as packaged and prepared products.

Risks

The key risks that could affect Orsero's revenue and profitability include:

Climatic and weather risks, pests, and diseases: The fresh produce industry is highly vulnerable to adverse weather conditions, which can affect crop yield and quality. Crop diseases and pest infestations may also result in significant losses and increased costs. However, as a distributor rather than a producer, Orsero benefits from a large network of global suppliers to help mitigate these risks.

Transport and logistics: Rising fuel costs, potential disruptions in shipping routes, and logistical delays present operational challenges that could impact efficiency and costs.

Political instability in supplier countries: Orsero's suppliers are located in regions that may experience political instability, which can disrupt the supply chain and affect operations.

M&A: There is a risk associated with acquisitions that may not deliver the anticipated value. Although recent acquisitions have been relatively inexpensive, the potential for value dilution remains a consideration.

MOAT/Competitive Advantages

Orsero's competitive advantages are deeply rooted in its vertical integration, covering production, logistics, and distribution. This structure provides the company with greater control over costs and margins. The use of a dedicated fleet of five ships for fruit transportation enables faster delivery compared to competitors. Orsero’s long-term supplier relationships and diverse customer base further secure its position in the market.

Competitors

The sector is characterised by significant fragmentation, with numerous active competitors. However, several notable acquisitions and mergers have taken place, as detailed below:

Chiquita Brands International: Acquired by Cutrale Group and Safra Group in 2015.

Fyffes: Acquired by Sumitomo Group in 2017.

Total Produce and Dole Food merger: In 2021, Total Produce and Dole Food Inc. merged to create Dole Plc., a primary competitor with a similar business model.

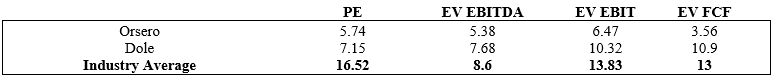

Currently, the main competitor is Dole, which also has a vertically integrated structure. Although both companies are currently trading at multiples below the industry average, Orsero is valued at more attractive multiples compared to Dole. This indicates that a similar business model is being undervalued by the market.

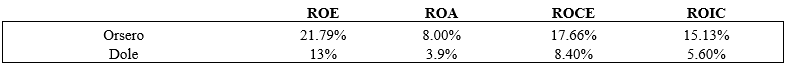

Orsero's financial returns are notably strong compared to its main competitor, and I anticipate that these returns will be sustained or increased over the long term.

Some key figures.

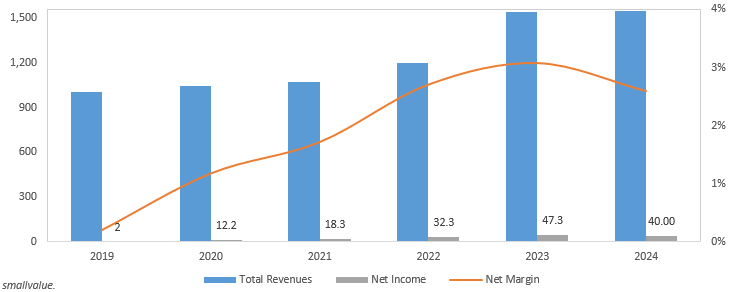

Over the past seven years, Orsero has increased its sales by 64%, achieving a compound annual growth rate (CAGR) of 8.6%. In 2023, the company reported a turnover of €1,540.8 million, reflecting a 28.8% rise compared to 2022. However, growth is expected to moderate in 2024, with projected revenues of approximately €1,545 million, as the shipping and banana markets normalize, bringing profitability in line with historical trends after an exceptional 2023. While the company posted a free cash flow (FCF) of €-9 million in 2023, largely due to acquisitions, FCF is anticipated to recover to around €20 million in 2024, with a projected FCF yield of 9%. Orsero remains financially robust, with total debt reduced to €218.7 million and net debt at €128.6 million as of December 31, 2023.

The attached chart shows how, during the COVID-19 pandemic and despite various geopolitical conflicts, the company has managed to increase both its sales and revenue. While margins have fallen, they remain high despite the normalisation of the shipping and banana business. This demonstrates the resilience of Orsero's business model and the ability of its management team to effectively handle adverse situations.

In 2017, Orsero experienced a drop in its share value following the release of its first-half results, which were negatively affected by the performance of its import and distribution division. The group’s profitability was pressured by an unfavourable environment in the banana and avocado markets. In the case of bananas, an oversupply reduced import prices, while in avocados, global demand outpaced supply and a temporary shortage in Mexico increased purchase prices, without these being reflected in selling prices. Additionally, a 76% increase in fuel prices compared to the previous year and associated operational issues raised costs. The other significant decline in Orsero’s share value has been recorded this year, with a reduction of over 25% year-to-date (YTD).

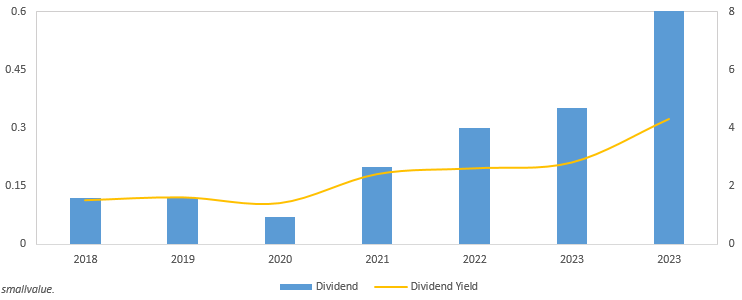

It is important to note that, although Orsero follows a consistent dividend distribution policy, it does not distribute high dividends (20/30%). The company’s strategy does not focus on profit distribution, as it has sufficient margin to continue investing in its growth.

Orsero operates in a relatively illiquid market, which does not necessarily represent a disadvantage. The lack of liquidity allows for acquiring companies at lower valuations than in liquid markets. Furthermore, investors can benefit from lower volatility, generating long-term value. Typically, shares of a good company tend to become more liquid over time, as investors start to take notice of its performance. The illiquidity of Orsero is due to its size, the sector in which it operates, and the country of is listed.

Valuation

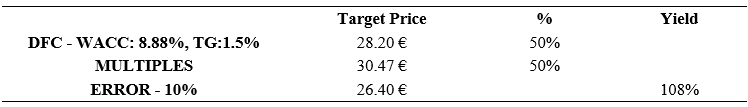

The valuation of Orsero is based on a discounted cash flow (DCF) analysis up to 2027, using a WACC of 8.88% and a terminal growth rate of 1.5%. An EBIT margin of 3.5% has been projected for the next four years, slightly lower than in previous periods. Additionally, a risk-free rate of 3.5% has been used, which is slightly higher than usual to stress the value. These assumptions lead to a valuation of €28.20 per share.

Valuing the company using multiples and assigning a P/E ratio of 14x, an EV/EBITDA of 8.6x, an EV/EBIT of 13.80x, and an EV/FCF of 13x results in a similar target price of €30.47. If each valuation is weighted equally, the weighted target price results in €29.34, representing an increase of more than 100% compared to the current price (€12.68).

The valuation has been carried out under a neutral scenario, although I typically apply a margin of error of 10% to the target price to cover possible deviations if the projections prove too optimistic. After applying this discount, the adjusted target price is €26.40, representing an increase of 108%.

Conclusion

Overall, I reaffirm my positive stance on Orsero due to its strong cash generation profile, top-tier management team, and resilient business model.

I believe the company is undervalued for several reasons. Firstly, it is a small-cap company with a market capitalisation of just €225.27 million. Additionally, it has low liquidity, which may limit investor interest. Finally, it operates in the food sector, which is viewed as less attractive, potentially resulting in a lower valuation compared to more popular sectors.

Despite these factors, the company exhibits considerable growth potential. However, investors should adopt a genuinely long-term perspective, as the company will not reach its true value overnight due to the aforementioned factors. What is clear is that the outlook for the company is positive. The food sector is essential, and with the increasing trend towards healthier lifestyles, Orsero’s products will continue to be in demand. Furthermore, the company still has room to grow and expand into other countries.

Disclaimer: This is a personal analysis and does not constitute any buying or selling recommendations. Each investor should make their own due diligence.

Thank you for making this company known.

After a brief analysis, it seems to me to be clearly undervalued and with great potential for appreciation.

The question is always the same: when will the stock reflect its real value?

While we wait, we are well compensated through a juicy dividend and share buybacks.

I rate this stock a clear a buy.

Thanks for the write-up. I have a question on the relative valuation table, specifically Orsero EV FCF entry of 3.5. It seems inconsistent with the data regarding a MC of some 200M and net debt of 128M with a 2024 expectation of 20M in FCF - this would seem rather like 15x EV FCF to me. Can you comment how where that table entry stems from? Thanks!