Brief Summary: Toya, a Polish small-cap company with a market capitalization of approximately PLN 540 million, is listed on the Warsaw Stock Exchange. Founded in 1990 by Jan Szmidt, it specializes in importing and distributing hand tools, power tools, and household appliances. It went public in 2011 at PLN 2.8 per share. Since its initial public financial statements in 2008, Toya has achieved a compound annual growth rate (CAGR) of 9.46% in sales and 10.40% in net profits, consistently delivering double-digit returns on invested capital. Currently, the company is trading at a P/E ratio of 7x.

Company Overview

Founded in 1990 by Jan Szmidt, just one year after the fall of communism in Poland, Toya has been under Szmidt's leadership as Vice Chairman of the Supervisory Board since 2011. He owns nearly 40% of the company’s shares. Today, Toya is an importer and distributor, operating five distribution centers, specializing in hand tools, power tools, and everyday household appliances, all manufactured based on its own designs. The company focuses on two main segments: domestic and professional. While Toya designs its products, it outsources production to China (a common practice in the sector) and transports the products by sea. Currently, Toya offers around 13,000 products, releasing approximately 800 new items each year to expand its product range. The company sells its products in over 120 countries worldwide under six different brands, each targeting a specific market niche.

Brand portfolio:

YATO: Toya's flagship brand, YATO is known for its professional-grade tools designed for automotive repairs, construction, and gardening. Offering a range of battery, electric, pneumatic, combustion, and manual tools, YATO provides exceptional value with high-quality materials and versatile solutions, making it a trusted choice among both professionals and DIY enthusiasts.

VOREL: VOREL delivers a wide array of hand and pneumatic tools for workshops, construction sites, and home use, offering excellent quality at competitive prices. The brand’s product range caters to electricians, locksmiths, maintenance technicians, plumbers, and hobbyists, with additional solutions for organizations in both home and workshop environments.

STHOR: Targeting discerning DIY enthusiasts, STHOR offers reliable and stylish electric tools for construction, renovation, and finishing tasks. The brand also provides tool kits, accessories, and equipment designed for garage and home workshop use, focusing on both performance and aesthetics.

LUND: LUND offers multifunctional household appliances that combine modern design with practical features. These user-friendly products enhance everyday activities such as cooking and cleaning, seamlessly blending into any home environment.

FLO: Specializing in tools for garden care, FLO provides both manual and electric tools designed for maintaining gardens, terraces, and balconies. The brand’s range ensures efficient and effortless upkeep of green spaces.

FALA: FALA presents a stylish selection of kitchen and bathroom faucets, shower panels, and linear drains. Its modern designs, paired with refined details, create elegant and cohesive aesthetics, complemented by a range of accessories to complete the look.

Toya's current organizational structure is as follows:

In the past, Toya had a subsidiary called Toya Golf & Country Club, which was involved in the sale of leisure, sports products, and real estate. However, this subsidiary was liquidated. On June 19, 2013, Toya Golf & Country Club Sp. z o.o. was removed from the judicial register following its liquidation. Additionally, it is worth noting that YATO Tools Jiaxing is Toya's most recent subsidiary, established in 2019 and located in Baibu Town, China.

Business Model

Toya’s business model is both clear and effective: the company designs its products in China, following industry standards, before importing and distributing the finished goods globally. Toya operates in two main market segments: professional-grade tools and tools for the "Do It Yourself" (DIY) market. These products cater to a wide array of industries, including automotive, construction, plumbing, electrical systems, HoReCa (Hotels, Restaurants, and Catering), bathroom, kitchen, gardening, security, and healthcare. This broad market reach enables Toya to generate diverse revenue streams.

Operational entities of the company:

Toya operates through four key business segments: local sales in Poland, Romania, and China; wholesale distribution; online retail; and international exports. The company provides a comprehensive product range for both professionals and DIY users, ensuring competitive pricing and broad accessibility. With a diversified and strategically managed supplier network, Toya maintains strong negotiating leverage and operational independence. Its subsidiaries, YATO Tools (Shanghai) and YATO Tools (Jiaxing), strengthen its presence in Asia. Additionally, the company’s adaptive sourcing strategy allows for flexibility in response to market changes.

Shareholders

Jan Szmidt: Holds 37.69% of the shares and an equal percentage of the voting rights, with a total of 28,284,304 shares.

Romuald Szatagan: Owns 12.86% of the shares and voting rights, amounting to 9,652,290 shares.

Generali OFE: Holds 6.66% of the shares and voting rights, with a total of 5,001,147 shares.

Romuald Szatagan, one of Toya's co-founders alongside Jan Szmidt, no longer participates actively in the company’s day-to-day operations. Generali OFE is a Polish pension fund. The remaining shares are held by additional funds, mostly retail investors. This shareholder structure is optimal, as the majority shareholder has a position on the Supervisory Board, enabling direct control over the three main board members. Furthermore, the second co-founder holds a significant stake, reflecting confidence in the company's future. Finally, the pension fund, which typically seeks to avoid high risks, also demonstrates its interest in maintaining stability.

Risks

Low free float: The majority of shares are held by management, posing a delisting risk, though unlikely.

Forex: Exchange rate fluctuations and currency mismatches between the base currency (PLN) and the local currencies where Toya operates may affect financial results.

WC dependence: Toya requires substantial working capital to operate, and inefficient inventory management could negatively impact its results. However, the company effectively manages these aspects, minimizing potential risks, making this less of a concern.

Revenue exposure to conflict zones: 11% of revenue comes from conflict areas (Russia, Belarus, Ukraine), but this risk is low due to Toya's distribution model.

Competitive industry: Toya operates in a highly competitive market with easily replicable products.

Liquidity issues: The 2018 fraud allegations involving GetBack and Altus had a negative impact on liquidity. A similar event could occur again, potentially affecting Toya's market price and investor confidence.

Online sales performance: Failure to drive online sales could limit retail growth.

Competitive advantage.

Toya delivers high-quality products at a lower price than its competitors, securing a strong position in the industry. Customer feedback—gathered from reviews and direct user interactions—is overwhelmingly positive. The company's strategic locations in Poland and Shanghai enhance its distribution network and market reach. Additionally, Toya gains a competitive edge by operating in regions with lower labour costs than its rivals in higher-cost areas, resulting in greater cost efficiency and a more favorable cost structure.

Competitors.

TOYA operates in the mechanical hand tools industry, a market valued at approximately USD 37 billion, with an expected annualized growth of over 4/5% until 2030. The sector is highly fragmented, comprising numerous players, both large and small. While publicly traded companies in this industry—especially smaller ones comparable to TOYA—are rare, we can find bigger players like Makita Corp, Techtronic Industries Co, Snap-On Inc., and Stanley Black & Decker.

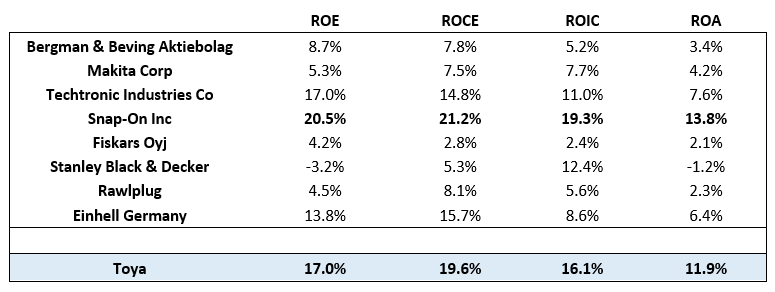

TOYA stands out with a 14% annualized sales growth over the past five years (through 2023). Its profit margins are higher than its peers, primarily due to lower labour costs, as its operations are concentrated in Poland and China, whereas competitors employ staff in higher-wage countries. Additionally, TOYA benefits from an efficient logistics system, with strategically located distribution centres that minimize costs. TOYA's financial returns are notably strong compared to its main competitors, with only Snap-On Inc.—a much larger company and not 100% comparable in terms of business model and the products and services offered—able to match its performance. Given TOYA’s operational efficiency and cost advantages, I anticipate that these returns will be sustained or even increase over the long term.

Key numbers.

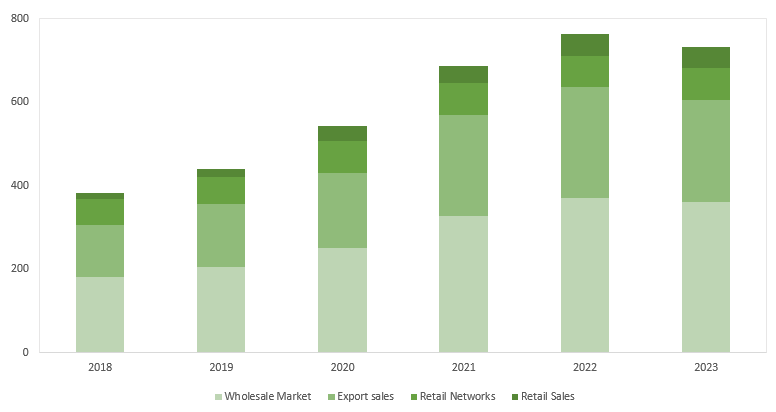

Toya is one of Poland’s leading companies, with an international presence and a solid track record of growth. Between 2016 and 2023, its revenue grew at a compound annual rate of 13.06%, while operating income increased by nearly 10% annually, maintaining stable margins. The company's gross margin ranged between 32% and 37%, while its operating margin remained between 10% and 14%, reflecting its high operational efficiency. The slight margin decline in recent years is primarily due to cost pressures, particularly from utilities (electricity, gas) and transportation expenses. In 2023, Toya reported sales of 732 million PLN, marking a 4% decline compared to 2022. This decrease was mainly driven by lower export volumes, particularly due to reduced sales to its Romanian subsidiary, as supply chain management has been shifted directly to China. However, its flagship brand, Yato, saw only a 2% drop in sales, whereas the rest of its brands experienced a 9% decline. Yato, which has historically maintained double-digit growth, is expected to continue this trajectory.

Despite market challenges, Toya has achieved organic growth, with only one acquisition in 2014 (100% of shares in the Chinese company YATO Tools). The company has avoided relying on acquisitions, aggressive pricing strategies, or significant marketing spending. This approach aligns with the nature of its industry, which doesn’t require substantial R&D investments, resulting in highly predictable growth and profitability.

Notably, even during the COVID-19 pandemic and the Russia-Ukraine conflict, Toya did not experience a decline in sales, demonstrating its resilience. Additionally, the company generated over 100 million PLN in free cash flow (FCF) in 2023, a figure that is expected to continue increasing.

The majority of Toya’s revenue comes from wholesale sales, which accounted for 49% of total sales in 2023, consistently ranging between 46% and 49%—the dominant sales channel in the industry, as seen across all major companies. Exports continue to grow as the brand expands into more countries, further strengthening its international presence. Additionally, e-commerce sales, which began rising during the COVID-19 pandemic, are steadily increasing, gradually absorbing a larger share of traditional retail sales. Looking ahead, I expect this channel to play an even more significant role in the company’s profitability and believe it should be further developed to maximize its potential.

The company maintains a positive working capital, which is essential given its operating cycle, where payments are made upfront and collections occur later. This working capital is primarily financed through short-term loans. While this financing model might raise concerns if the company had a high level of debt, that is not the case with Toya. The company enjoys a solid financial position, with a net debt to EBITDA ratio of just 0.4x (LTM), indicating low leverage. In fact, in 2023, this ratio was negative, as the company closed the year with net cash, reflecting its strong liquidity and ability to generate internal resources. Over the years, Toya has improved its efficiency, reducing its cash conversion cycle from 338 days in 2018 to 216 days in 2023, driven by better management of receivables and inventory.

It is worth noting that the company does not distribute stable dividends, as its strategy is not focused on dividend payments. Toya has significant growth potential, with a clear focus on reinvesting in new product development and expanding its market reach. Additionally, the company has repurchased its own shares, reducing the total number of shares from 78.5 million in 2016 to 75 million today. Recently, Jan Szmidt, Deputy Chairman of Toya's Supervisory Board, proposed allocating PLN 100 million in reserve capital for the repurchase of Toya shares. The buyback program will cover up to 12.5 million shares, with a purchase price ranging from PLN 6 to PLN 18 per share.

Valuation

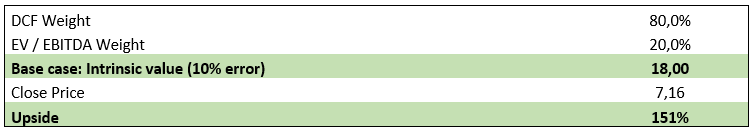

For the valuation of Toya, we will use both a Discounted Cash Flow (DCF) model, projected over four years, and a multiples-based valuation using the EV/EBITDA ratio. Given the lack of directly comparable companies to Toya, we will assign an 80/20 weighting in favour of the DCF approach. Note that this analysis only presents the base-case scenario; downside risks also exist, and those have been modelled separately. Therefore, you should conduct your own valuation based on your projections. Keep in mind that this is merely a summary of a more extensive underlying analysis.

In the DCF model, projected through 2027, we assume an EBIT margin of 12% (below the company's historical average), a growth rate (g) of 1%, and a discount rate (WACC) of 9.23%. The WACC is calculated by weighting the risk-free rate across the countries where the company operates, with an additional stress factor of 20bps, resulting in a rate of 5.38%. Based on these parameters, we arrive at a valuation of 19.71 PLN per share, implying an upside potential of over 150% from current price levels.

For the EV/EBITDA multiple-based valuation, we assume the company should trade at 12x EBITDA, a conservative multiple below the sector median of 13.4x. This results in a valuation of 19.92 PLN per share, closely aligning with the DCF outcome.

By combining both approaches—giving greater weight to the DCF due to the lack of direct peers—we apply an 80% weight to the DCF and 20% to the EV/EBITDA multiple, leading to a final valuation of 20 PLN per share. However, to account for potential over-optimism, we apply a 10% margin of error, ensuring a more conservative perspective. Even under this adjusted scenario, the stock still presents an upside potential of over 150% from current levels.

Conclusion

Toya is currently trading at a significantly low valuation compared to the market average. Despite operating in a relatively unattractive sector and a financially stable country, the company has strong long-term prospects. Its management team is dedicated to creating value for both the company and its shareholders. The company’s undervaluation can be attributed to several factors: it is a small-cap company in a less attractive sector, listed in a country not widely represented in global markets, and has low liquidity, which may limit investor interest. However, these characteristics make Toya an appealing investment, especially due to the significant ownership stake held by its founders, demonstrating a strong alignment with long-term goals.

“Alluvia Capital on the Polish market: In 2021, we conducted an in-depth exploration of Poland, discovering the Warsaw Stock Exchange as a hidden gem. The market is home to numerous profitable, growing small companies with robust balance sheets and significant insider ownership. Despite being one of Europe's most dynamic markets, it remains largely under the radar for US investors”

Disclaimer: This is a personal analysis and does not constitute any buying or selling recommendations. Each investor should make their own due diligence.

Nice write up! Own shares too and think has room to run.

Missing depth but you’re on the right track! Toya is indeed a pretty damn good company. Thanks for sharing