Olvi: Playing with the Big Fishes

Low valuation multiples. Excessively punished in its market price. Skin in the game (Olvi Foundation 16.19%).

Brief Summary: Olvi Oyj, based in Iisalmi, Finland, is a leading international beverage company with a history dating back to 1878. Initially founded by William Gideon Åberg, the company has expanded significantly over the years, operating in Finland, the Baltic Sea region, and Belarus. Olvi's diverse product portfolio includes beer, soft drinks, and non-alcoholic beverages, with a growing focus on healthier alternatives. The company has a strong international presence, exporting to 70 countries and employing over 2,000 people. In 2023, Olvi reported revenues of €630.6 million and is listed on the Helsinki Stock Exchange.

Company overview and history

Olvi Group is a prominent international beverage company with operations spanning six countries and a heritage dating back to 1878. Founded by master brewer William Gideon Åberg and his wife, Onni, in Iisalmi, Finland, the company aimed to provide Finns with milder alcoholic beverages as an alternative to combat alcoholism. Today, Olvi is the only independent Finnish brewery among the 78 operating at its inception.

The company's international expansion began in 1996 with a minority acquisition of Tartu Ölletehas (now A. Le Coq) in Estonia, followed by majority stakes in Cēsu Alus (Latvia) in 1999 and Ragutis (Lithuania, now Volfas Engelman) in 2000. Subsequent acquisitions included Lidskoe Pivo (Belarus) in 2008, Finnish importer Servaali and The Helsinki Distilling Company in 2018, and Piebalgas Brewery (Latvia) and A/S Bryggeriet Vestfyen (Denmark) in 2021.

Operating across three primary segments—Finland, the Baltic Sea region, and Belarus—Olvi’s portfolio includes beer, soft drinks, and mineral waters, with a growing emphasis on non-alcoholic beverages. In 2023, the company exported to 70 countries, supported by 2,376 employees and a commitment to innovation and sustainability.

Business model

Olvi Oyj generates revenue through the production, distribution, and sale of a diverse range of beverages, including alcoholic drinks such as beer and non-alcoholic products like soft drinks, mineral water, and flavoured options. Headquartered in Finland, the company holds a good market share position, with a growth strategy that emphasises both domestic market dominance and international expansion.

Operating under a vertically integrated business model, Olvi manages in-house production while sourcing raw materials externally. The company owns and operates breweries and distilleries, positioning itself strategically in key markets and ensuring efficient supply chain operations. This diverse manufacturing footprint supports Olvi's wide geographic reach and local market adaptation.

Olvi’s portfolio is broad in price point, with products spanning almost all price segments, particularly in Finland. This diversity allows the company to navigate varying market environments effectively. In 2023, Olvi emphasized product optimization, leading to an improved sales mix and positioning the company for better resilience and profitability.

A key growth driver for Olvi has been its aggressive acquisition strategy. The company has expanded significantly through the purchase of local breweries and beverage brands, such as A. Le Coq in Estonia, Volfas Engelman in Lithuania, and Lidskoe Pivo in Belarus. These acquisitions not only broaden Olvi's product portfolio but also enhance its distribution capabilities and facilitate entry into new regional markets, reinforcing its competitive edge across Europe.

Olvi distributes its products through an extensive network of wholesalers, retailers, and direct-to-consumer channels, ensuring broad market access. With a focus on operational efficiency and product quality, the company guarantees timely deliveries. Strategic retail partnerships and direct consumer engagement further enhance its global footprint.

In terms of product innovation, Olvi has focused on differentiation, particularly in the non-alcoholic beverage segment, in response to increasing consumer demand for healthier alternatives. Through tailored products, innovative packaging, and sustainable practices, Olvi not only meets local market preferences but also appeals to environmentally conscious consumers.

Revenue is primarily generated from the sale of beverages across both domestic and international markets. Olvi’s robust export business plays a crucial role in its turnover. Through strategic acquisitions, operational efficiency, product innovation, and regional market expansion, Olvi is well-positioned for long-term profitability and sustainable growth within the competitive beverage industry.

Industry context

The beverage markets in the Baltic region are experiencing robust growth, driven by shifting consumer preferences toward healthier, more sustainable options, as well as the increasing popularity of craft and non-alcoholic drinks. In Finland, while beer remains dominant, there is a notable shift toward non-alcoholic and low-alcohol alternatives, fuelled by wellness trends and a growing demand for eco-friendly products. Despite challenges posed by high taxes and stringent regulations, companies like Olvi have successfully adapted by diversifying their offerings, maintaining strong growth in this competitive market.

Similar trends are evident in Estonia and Latvia, where beer continues to lead, but low-alcohol and non-alcoholic beverages are gaining market share. Olvi’s subsidiaries, A. Le Coq in Estonia and Cesu Alus in Latvia, have expanded their portfolios including healthier options, while the craft beer segment continues to grow. Estonia’s more flexible regulatory environment fosters broader distribution, further supporting market expansion. In Latvia, despite high alcohol taxes, a favourable regulatory framework allows for growth, with both local and international brands capitalizing on the demand for craft and health-conscious products.

Lithuania’s market is increasingly driven by the demand for low-alcohol and sustainable products, especially among younger consumers. The country’s more flexible regulatory framework facilitates broader distribution, further accelerating sector growth. In Belarus, while beer and kvass remain the dominant beverages, there is a growing interest in premium, low-alcohol, and non-alcoholic options. Olvi’s subsidiary, Lidskoe Pivo, plays a key role in this market, benefiting from a cost-effective local production environment to support its growth and competitive positioning.

Overall, while beer remains the dominant category across these regions, the growing demand for non-alcoholic beverages—including soft drinks, energy drinks, flavoured waters, and large-format drinks—is reshaping the market landscape. With its diversified portfolio and strong regional presence, Olvi is well-positioned to capitalise on these emerging trends and drive sustainable growth in the years ahead.

Risks

The key risks that could affect Olvi Group’s revenue and profitability include:

Geopolitical and Belarusian markets: Ongoing geopolitical tensions, including the war in Ukraine, have heightened uncertainty in areas such as raw material procurement, logistics, and energy costs. These challenges are further intensified by trade sanctions and shifting local regulations, particularly in markets like Belarus. In Belarus, Olvi faces additional risks such as currency devaluation, unpredictable legislative changes, and trade sanctions, all of which could disrupt operations and impact profitability. Furthermore, the political instability in Belarus adds to the complexity, creating potential difficulties in maintaining business operations and financial transactions with Western countries.

Supply chain disruptions: The COVID-19 pandemic and the war in Ukraine have caused ongoing challenges in the availability and pricing of raw materials (e.g., barley malt, sugar) and packaging materials. Fluctuating energy costs and high logistics expenses further increase operational costs.

Consumer behaviour changes: Rising inflation and reduced purchasing power in Europe are driving consumers to seek more affordable alternatives, potentially reducing overall consumption and impacting the sales of premium products. Additionally, as consumer trends evolve, there is a noticeable decline in alcohol consumption, with a growing demand for alternative beverage options. Olvi offers diverse products with a wide price range, keeping their risk low.

Sustainability and regulatory risks: Olvi faces risks related to sustainability, particularly concerning human rights and environmental factors. Ongoing assessments and regulatory changes will require continuous adaptation to meet legal requirements and consumer expectations.

MOAT/Competitive advantages

Olvi's competitive advantages are rooted in its vertical integration, strong domestic presence, and deep regional expertise, enabling it to cater effectively to local demands with a dynamic, consumer-driven product portfolio. The company’s streamlined production processes and integrated distribution network ensure reliable delivery across key markets, while its experience in both retail and the HoReCa sectors bolsters its market position. Strategic partnerships and a robust international network drive ongoing innovation and growth, supported by a solid financial foundation, strong brand loyalty, and dominant local market shares, positioning Olvi for sustained long-term success.

Competitors

The beverage industry is marked by significant fragmentation, with a diverse array of competitors vying for market share. Key players include global giants such as Royal Unibrew, Carlsberg, and Anheuser-Busch InBev. Both the beer and soft drink segments are characterized by intense price competition and robust marketing efforts. Declining beer consumption in Europe has spurred companies to expand and diversify their product offerings. As consumer preferences evolve, the market landscape has become increasingly fragmented, complex, and sophisticated.

In this competitive environment, Royal Unibrew and Carlsberg emerge as the primary rivals to Olvi, both employing vertically integrated business models. However, these competitors are significantly larger and have a broader international reach. Among the market leaders, Royal Unibrew stands out as Olvi's main peer for comparison in this market. The company boasts a higher valuation, increased debt levels (with net debt of approximately $798 million compared to Olvi's net cash position of $30 million), and has issued new shares over the past two years, in contrast to Olvi's stable share count of 20.7 million.

From a valuation perspective, Olvi presents more attractive multiples than Royal Unibrew, suggesting the market may undervalue Olvi despite comparable business models. Olvi's Free Cash Flow (FCF) yield further underscores its financial strength, at an impressive 8.95% compared to Royal Unibrew’s 5.30%. This indicates Olvi’s superior cash generation relative to its market value, offering a compelling case for higher investor returns.

Within the broader industry, which trades at median multiples of P/E 19x, EV/EBITDA 14x, and EV/EBIT 16x, Olvi is the only company trading below these benchmarks. This discounted valuation offers a potential opportunity for superior investor returns relative to peers.

Olvi's financial metrics further differentiate it from competitors. The company exhibits stronger performance across key indicators such as Return on Equity (ROE), Return on Assets (ROA), Return on Capital Employed (ROCE), and Return on Invested Capital (ROIC), signalling robust operational efficiency and profitability. This positive trajectory is likely to persist and potentially accelerate over the long term.

Some key figures.

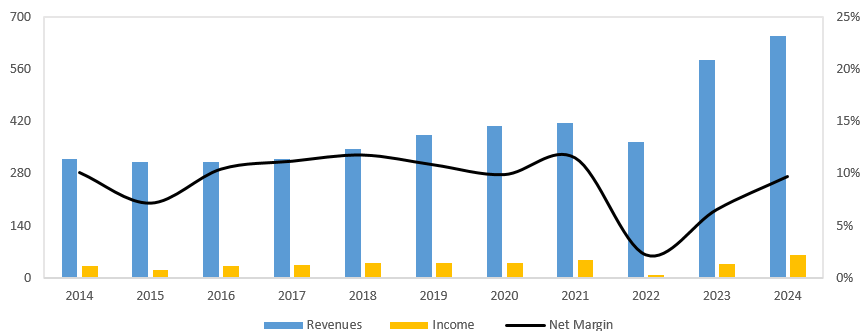

Over the past decade, Olvi has demonstrated impressive growth, achieving a 100% increase in sales, equating to a compound annual growth rate (CAGR) of 7%. In 2023, the company reported a turnover of €630.6 million, marking an 8% year-over-year increase. However, I project that growth will moderate in 2024, with projected sales of approximately €655 million. Olvi remains financially robust, with a free cash flow to the firm of €29 million, a low total debt of €7 million, and a negative net debt position of nearly €25 million as of December 31, 2023.

The company has consistently increased its sales and revenue, with the notable exception of 2022. During that year, Olvi achieved a 23.6% rise in sales and a 12% increase in volume (measured in million litres), but net income fell to €7.52 million, down from €48.4 million in 2021. This decline was primarily due to rising inflation, interest rate hikes, and increased investments, which compressed margins. The cost of sales increased by €94.5 million, or 35.1%, year-on-year, which is significantly higher than the increase in net sales. Additionally, logistics, sales, and marketing expenses grew. Despite this, Olvi is on track to regain its growth momentum, with net profit in 2024 projected to exceed €55 million, representing a 15% increase compared to 2021. This underscores the resilience of Olvi’s business model and its management's ability to navigate challenging market conditions.

Between late 2021 and mid-2022, Olvi’s share price dropped sharply by approximately 45%, primarily due to the escalating conflict between Russia and Ukraine, which had a direct impact on Olvi’s operations in Belarus. The company attempted to sell its 96.4% stake in Lidskoe Pivo, but the sale was blocked by geopolitical factors and sanctions that disrupted acquisition channels and financial transactions. While Lidskoe Pivo’s operations have been partially separated from Olvi Group and now function independently, it still adheres to Olvi’s core policies, maintaining Western operating standards across all markets. Despite these challenges, Lidskoe Pivo continues its growth trajectory. Should a sale of the stake occur, the proceeds would be noted in Olvi’s cash balance and reinvested into the company, supporting product development, facility improvements, and potentially expanding into new regions. Alternatively, if the Belarusian subsidiary remains within the group, it is poised to continue delivering strong returns. With Olvi shares currently trading at a discount, significant upside potential exists in either scenario.

Additionally, Olvi adheres to a dividend distribution policy, with a payout ratio exceeding 41%. While the company distributes a portion of its profits to shareholders, its primary focus remains on reinvesting to drive further growth, as it has significant capacity for expansion.

Operating in the relatively illiquid Finnish market, Olvi faces lower liquidity, which, in turn, can lead to more conservative valuations compared to more liquid markets. This presents opportunities for strategic acquisitions and offers lower volatility, supporting long-term value creation. Over time, the shares of high-performing companies typically become more liquid as investor interest grows. Olvi's illiquidity is a result of its size, sector, and listing in Finland.

It is also important to highlight that the European Food & Beverage sector remains an attractive investment case. Despite a substantial rise in profits—48% higher than previous levels—sector valuations have reverted to 2012 levels, with earnings nearing record highs. Over the past decade, the sector has experienced significant de-rating, with price-to-earnings (P/E) multiples decreasing from 22x in 2014 to an estimated 16x in 2025, presenting a more favourable valuation relative to performance.

Valuation

Olvi's valuation is based on a discounted cash flow (DCF) analysis extending to 2027, with careful consideration of the risks tied to its operations in Belarus. The valuation assumes that the Belarusian business does not contribute value, given the uncertainty surrounding the sale of Lidskoe Pivo, which I anticipate will eventually be completed, but likely at a discount to its intrinsic value. For this analysis, we have applied a weighted average cost of capital (WACC) of 6.89% and a terminal growth rate of 2%. We project an EBITDA margin of 14% over the next four years, slightly below historical averages, and have used a higher-than-usual risk-free rate of 3% to account for additional uncertainty. These assumptions yield a valuation of €37.70 per share.

Additionally, a multiple-based approach has been used to cross-check the DCF outcome. Using a P/E ratio of 13x, EV/EBIT of 11x, and EV/FCF of 16x, the resulting target price is €37.60 per share. By equally weighting both the DCF and multiple-based valuations, we arrive at a combined target price of €37.67, representing an upside potential of approximately 35% relative to the current share price of €28. Furthermore, Olvi offers an attractive dividend yield of 4.25% per annum.

* For a more realistic approach to valuation, a range is provided, with the target price fluctuating between €33.35 and €42.36. This range suggests significant upside potential from current price levels, reinforcing the investment opportunity’s attractiveness.

That said, while the valuation is relatively close to the current levels, I expect projections to rise in the future. The sale of the Belarusian subsidiary would further strengthen Olvi’s financial position by generating additional cash, improving its balance sheet, and supporting its expansion plans in Northern and Central Europe. It would also enable Olvi to continue expanding its portfolio of non-alcoholic products. Most importantly, the sale would significantly reduce the company’s risk profile, leading to a more favourable market perception and likely boosting investor confidence.

Please note that this valuation represents just one scenario. There are additional scenarios considered, so these prices should not be taken as the sole valuation. This summary is based on a big analysis conducted in the background. Everyone is encouraged to conduct their own due diligence.

Conclusion

Olvi’s investment thesis is grounded in its solid financial position, characterized by positive net debt and a resilient balance sheet. This financial strength provides the company with the flexibility to allocate capital strategically, supporting its expansion efforts in the Nordics and Central Europe. In 2023, Olvi unveiled a comprehensive growth strategy, focusing on key initiatives: strengthening international partnerships to enhance its local offerings, entering new export markets through a targeted expansion plan, and promoting greater collaboration across its group operations. Furthermore, Olvi aims to refine its portfolio of group brands in select categories while pursuing strategic mergers and acquisitions to drive growth in both core and adjacent markets.

I remain confident in Olvi Oyj’s outlook, bolstered by its strong financial health, effective management, and well-executed growth strategy. Although risks such as geopolitical tensions in Belarus and potential regulatory hurdles may arise, Olvi’s resilient business model, operational efficiency, adaptability, and strong leadership provide a firm foundation for sustained growth. The company’s attractive valuation, trading at a discount relative to industry peers, coupled with robust cash flow, a disciplined dividend policy, and further growth opportunities through market penetration, product innovation, and operational enhancements, solidifies its appeal as a compelling investment.

Disclaimer: This is a personal analysis and does not constitute any buying or selling recommendations. Each investor should make their own due diligence.

Beautiful 📈📉

Very good analysis, thanks. I'm coming to a similar DCF and conclusion as you.